In a video on Wednesday, the popular YouTube channel More Crypto Online offered an analysis of Dogecoin’s price structure, suggesting that the meme-inspired cryptocurrency could be on the cusp of a breakout or breakdown—provided it falls below critical support levels. The analyst’s outlook centers around Elliott Wave counts, potential consolidation patterns, and pivotal price thresholds that could define Dogecoin’s short-term trajectory.

Dogecoin Teeters On The Edge

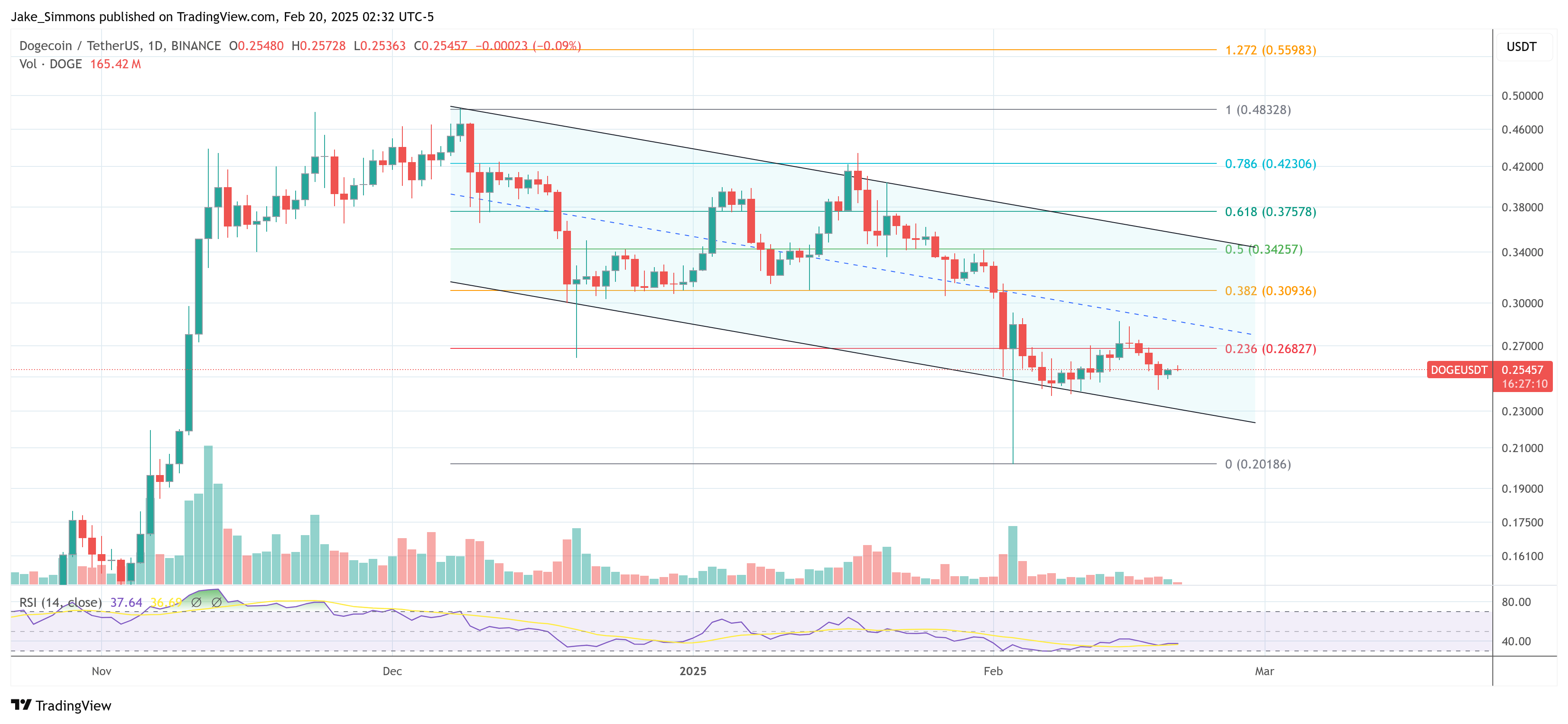

The analyst notes that Dogecoin has shown “only sideways action over the last few days, actually last 10 days or so,” following a significant selloff. According to the channel’s host, the price dipped into a previously identified support zone and has since failed to rally above the key resistance at $0.34:

“Unfortunately, we did not break above the $0.341 level in that recovery and we haven’t yet broken above any signal line, which is a shame because it keeps the price caught in this sideways consolidation mode,” he said.

Despite the muted price action, the analyst believes Dogecoin may still form a classic A-B-C corrective pattern, with the potential C-wave finding a bottom slightly below the A-wave low: “If this really is an A-B-C structure, the C-wave would normally end below the low of the A-wave […] doesn’t have to, but that seems to be likely.”

He estimates that the “ideal target” for the C-wave sits around $0.233 to $0.234, derived from measuring the length of the initial A-wave. Of particular importance is the $0.22 level, which aligns with the 78.6% Fibonacci retracement. Maintaining this zone is viewed as critical to preserving the broader bullish scenario: “Only as long as the market holds above $0.22, the overall let’s say bullish thesis remains intact […] ideally we’re holding above it.”

Any drop below this threshold would seriously dent the bullish case, and another lower figure, $0.204, is cited as the ultimate invalidation point. A decisive break under either level could signal further downside: “Any break below $0.22 will likely lead to invalidation […] the invalidation point itself is a little lower, however, that’s at $0.204 and we are far away from that at the moment.”

From the analyst’s perspective, Dogecoin would need to exceed certain “signal lines” to provide stronger evidence of a trend reversal. He highlights $0.293 as the first signal of a potential low, while a move beyond $0.342 would be considered a more definitive upside breakout trigger.

“Once we finally start the third wave […] we need to get above the first signal line […] better will be a break above the upper signal line at $0.342,” the analyst states. In that scenario, the structure would confirm a sustained bullish wave, potentially validating expectations of a more pronounced Dogecoin rally.

The analyst emphasizes that much of the crypto market remains in sideways territory. He specifically compares Dogecoin’s resilience to Solana, which he notes has “dropped quite a bit,” while Dogecoin appears to be “holding quite well.” Nevertheless, broader market sentiment and macroeconomic factors continue to influence price performance across the board.

At press time, DOGE traded at $0.25.

Laisser un commentaire