Bitcoin’s fresh record above $124,000 on Thursday set the stage for a stark test of one of oldest heuristics, according to Joe Consorti, Head of Growth at Theya. In a video published today, August 14, Consorti argued that the fourth quarter will reveal whether the market’s long-observed four-year halving cycle still governs price behavior—or whether the asset has entered a new regime shaped by deep, patient pools of traditional finance capital.

“Bitcoin just hit a brand new all-time high of more than $123,700,” he said at the top of the segment. “It’s since corrected slightly…but we’re still pushing higher.” That print aligns with Wednesday’s tape across major dashboards: Bitcoin price topped above $124,4000 today as macro traders leaned into a prospective Fed easing path and risk sentiment firmed.

Q4 Could Bury The 4-Year Bitcoin Cycle For Good

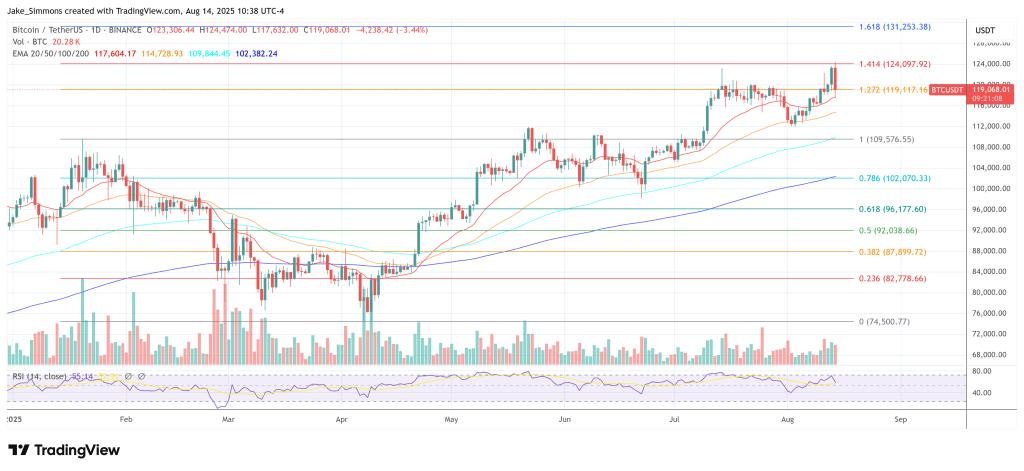

Consorti framed the breakout against a month-long tug-of-war around $118,000–$120,000, describing how “longs and shorts have been fighting back and forth for market control,” with bulls “slowly but surely” grinding out the upper hand. He tied the setup to the seasonal transition out of the “summer doldrums,” and to a policy backdrop he expects to turn supportive: “As Wall Street returns from vacation… the Fed is positioned for its first maintenance rate cut in a year as the US economy rebounds.” Futures markets have increasingly priced a September cut, a shift that has underpinned risk assets broadly alongside dollar softness.

The heart of Consorti’s thesis is that this expansion is structurally different. “This is also Bitcoin’s longest bull market ever… at 21 months compared to 13 months,” he said, using that duration to pose the key dilemma: “That begs the question, is the 4-year cycle dead? Well, at the very least, the 4-year cycle will be tested in Q4 of this year.”

He pointed viewers to analysis from on-chain researcher James Check (Checkmate) at CheckOnChain. “If we see a massive run-up and blow-off top at 4-year end, the theory remains intact… but if not, Bitcoin’s behavior through market cycles has probably changed forever.” Check, for his part, has recently written that “if there was ever a time for the 4yr Bitcoin halving cycle to break, this market environment is likely it,” underscoring how veteran on-chain analysts are also bracing for a pattern shift.

What’s changed, in Consorti’s view, is the buyer base. “Traditional finance capital pools have entered the picture, and they play by different rules.” He highlighted spot Bitcoin ETFs as the prime conduit: “These are purchased by retirees, pension funds, and endowments… These are allocators with no near-term intention of selling. They plan to hold it for years, even decades, and only gradually shave down positions over time.”

To illustrate, he cited Harvard University’s endowment: “Their endowment purchased 1.9 million shares of iShares Bitcoin Trust, valued at $116.7 million in Q2.” That position—disclosed in a recent 13F—impressively demonstrates the institutional adoption of BlackRock’s IBIT.

Consorti extended the long-horizon argument to treasury adopters: “These are firms holding Bitcoin on their balance sheets with no plan to sell. Ever… the serious players… are permanent fixtures in the market.” The implication, he said, is a visible evolution in market structure and tempo: “Instead of the violent booms and busts of earlier cycles, we’re seeing something new, which is a consistent uptrend punctuated by periods of consolidation, then rapid expansion, then consolidation again.”

As supply becomes increasingly lodged with long-duration holders and the asset’s capital base thickens, “volatility naturally compresses, but upside doesn’t vanish. It just plays out in longer arcs, with bigger dollar moves and a slower tempo.” He added that this maturation is already noticeable as Bitcoin grows “beyond its current $2.4 trillion market cap,” even as he acknowledged that the fourth quarter will be the crucible for the cycle debate.

“In Q4, that dynamic could be on full display,” Consorti concluded. A “mix of easing financial conditions, renewed institutional inflows post-summer, and persistent structural demand from ETFs, corporates, and high net worth allocators could set the stage for another leg higher and a banner Q4.” But his sign-off was deliberately non-deterministic: “Only after the fourth quarter of this year will we truly know whether or not the four-year cycle is truly dead and buried… We’ll just have to wait and see.”

At press time, BTC traded at $119,068.

Deja una respuesta