XRP is trading at $2.42 with a 24-hour volume of $5.1 billion. The token has fallen 3% in the past day and 15% over the last week.

While the short-term outlook in USD terms appears weak, current technical setups suggest XRP could outperform Ethereum soon.

Falling Wedge Pattern Suggests Possible Reversal

The XRP/ETH chart shows a falling wedge formation, according to CryptoBull. This setup features downward-sloping trendlines that gradually move closer together. The asset is currently near the lower support area at 0.0006 ETH.

#XRP is about to reach the end in this giant falling wedge against Ethereum. This is a structure that usually moves to the upside suggesting that XRP will outperform Ethereum in the coming weeks! pic.twitter.com/C3EwcUc6dB

— CryptoBull (@CryptoBull2020) October 15, 2025

Remarkably, this pattern often marks the end of a downtrend. If XRP moves above the upper line of the wedge, it could start gaining on Ethereum. A move beyond the 200-day moving average, which still acts as resistance, would confirm strength. Until then, the price is trading in a narrowing range.

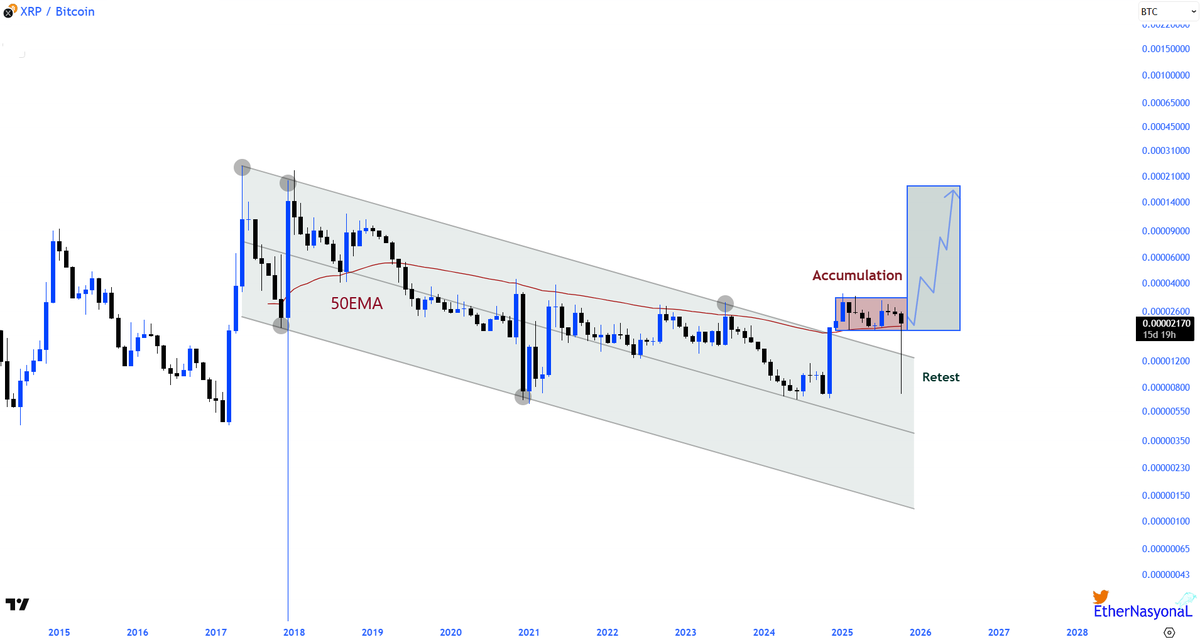

In addition, XRP has also moved above a falling channel on the BTC pair. This channel has been in place since 2017. In late 2024, XRP broke through this structure and moved above the 50-period exponential moving average, based on the chart posted by EtherNasyonaL.

After the breakout, price action shifted into a sideways range. This type of behavior is often seen when markets pause to gather strength. A recent pullback served as a test of the breakout zone. XRP stayed above the old resistance, which is now acting as support. This move suggests that buyers are still in control over the longer term.

Range Between Key Historical Levels

On the XRP/USD chart, the asset continues to move between $2 and $3.3. These are the highs from 2021 and 2017, respectively. According to analyst EtherNasyonaL, XRP remains in a reaccumulation phase. They wrote,

“Price is stuck in the reaccumulation phase between the 2017 peak at $3.3 and the 2021 peak at $1.96.”

This range is drawing attention from long-term holders. It is seen as a key area that could decide the next direction. If the asset breaks above $3.3, it may signal a much larger move ahead.

Recent Partnerships

Ripple has announced a new partnership with South Africa’s Absa Bank, which will use the former’s custody platform to manage tokenized assets. These include digital currencies and other blockchain-based products.

This agreement gives Absa access to Ripple’s tech stack while helping it expand its presence in African financial markets. Meanwhile, filings related to crypto-based ETFs, including those involving Ripple, are still under review by the US SEC.

职位 XRP Poised to Beat Ethereum? Key Levels Say It’s Coming 首次出现在 加密土豆.

发表回复