The cryptocurrency community witnessed one of its most volatile and challenging weeks in recent history. Bitcoin, for example, went from $100,000 last Saturday to over $108,000 by Tuesday to reach a new record but then dumped by $16,000 to a multi-week low of $92,000 after the Fed’s hawkish comments for 2025.

It has recovered about seven grand since then and is now close to $100,000 once again. Aside from causing billions of dollars worth of liquidations from over-leveraged traders, these enhanced fluctuations played with a lot of people’s emotions, with many speculating whether the bull cycle has ended.

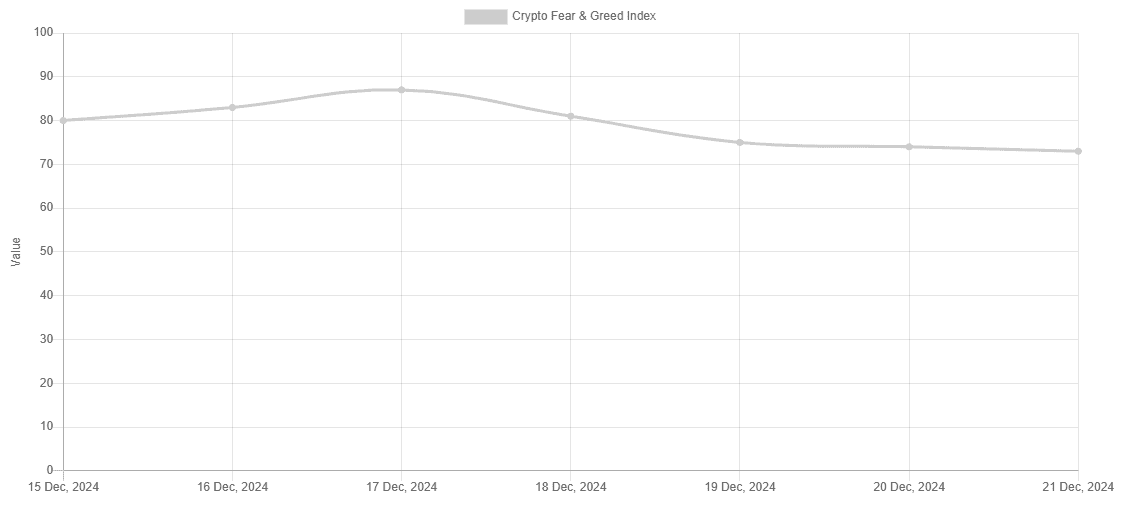

The Fear and Greed Index, a metric showing the overall sentiment in the crypto market toward BTC and the altcoins, went from deep ‘extreme greed’ of 87 down to just ‘greed’ – 73 in a couple of days. Such large differences only go to show the emotional part of the ever-volatile crypto market. Zooming out a bit, though, and it’s about perspective.

The Emotional Part

It’s obvious that we cannot exclude emotions from anything; otherwise, we wouldn’t be humans. The financial markets are no different, especially crypto, due to its substantial price fluctuations. One cannot just shut down their emotions when they see their portfolio going up and especially down by double-digits within a day or two.

Julian Hosp, Bake’s CEO, outlined the importance of emotions but also perspective in a recent X post during the correction. He believes the most vital part of people’s perspective is the direction and not the actual numbers.

“Here’s the crazy thing about crypto: It doesn’t matter if Bitcoin is at 30k, 60k, or 100k – it’s all about the direction. Price goes up? Everyone’s euphoric: 90k to 100k? Amazing. 108k to 100k? Disaster. Same price, totally different vibes.”

Let’s analyze what happens during those massive green or red candle periods. When BTC’s price surges toward a new all-time high, euphoria kicks in. Remember what happened back in 2021? Bitcoin jumped toward $70,000, and people put laser eyes on X (then Twitter) as they were focused on its price going to $100,000. And what happened next – BTC dumped and went into a year-long bear market.

Fear dominated during that dark period, especially when previous industry giants like FTX and Celsius went bust. The landscape changed once again in 2023 when BlackRock filed for a spot in Bitcoin ETF, which essentially guaranteed that the US SEC would finally greenlight such products. The same happened when Donald Trump, who made numerous pro-crypto promises during his campaign, won the elections, and BTC started pumping.

The asset indeed went into six-digit territory, and the aforementioned euphoria started to kick in. People celebrated when it hit $100,000, but it then tapped $108,000 and went back to $100,000 – this time, the overall sentiment was not all that bullish, even though it seemed impossible just two years ago to be at this level.

Mirror of Emotions

Hosp concluded that the crypto market is a “mirror of emotions: greed, feat, hope – it’s all about the feeling of where the market is heading.”

He noted that the ultimate utility is the price itself, and rationality goes away when that price and trends “dominate over facts.” He added that large green candles “generate more hype than any actual numbers ever could.”

We know it’s impossible to leave emotions at the door when dealing with finances, especially crypto. However, one should zoom out during such violent corrections as the one from this week and look at the bigger picture – is your portfolio better now than it was a few months/years ago? If yes, then keep calm and keep doing what you have been doing. If not, then you need to analyze what went wrong and how you can improve.

职位 Is Crypto the Ultimate Mirror of Emotions Like Greed, Fear, and Hope? 首次出现在 加密土豆.

发表回复