In an investor note dated April 15, 2025, Matt Hougan, the Chief Investment Officer (CIO) of Bitwise, shared an examination of Bitcoin’s recent trading patterns that may surprise both critics and supporters. “Bitcoin is acting like an asset that wants to go higher, if only macro obstacles would get out of the way,” he wrote.

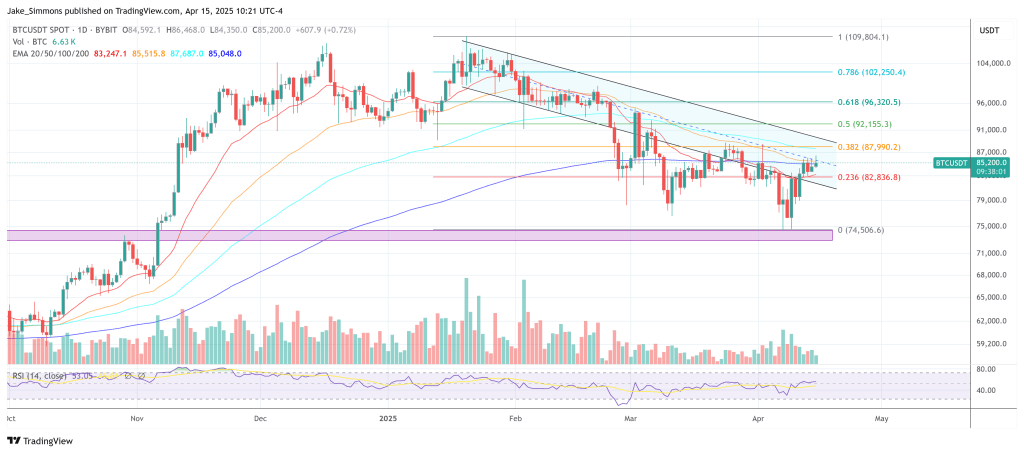

According to Hougan, Bitcoin’s price on April 14 hovered around $84,379, compared to $84,317 a month earlier—a minuscule change of 0.07% during a 30-day window. This flat performance emerged against the backdrop of two significant geopolitical events: the United States announcing the creation of a Strategic Bitcoin Reserve and President Donald Trump imposing sweeping tariffs on countries around the globe.

The resilience that Bitcoin has shown during this period stands in stark contrast to the broader downward trend in traditional financial markets. Hougan pointed out that the S&P 500, which peaked on February 19, has lost 12.0% of its value, with Bitcoin down a comparable 12.4% since that date.

He found this alignment astonishing, particularly because it departs from Bitcoin’s behavior during past market downturns. In the 2022 correction, for example, the S&P 500 slid 24.5% while Bitcoin plunged 58.3%. Similarly, at the onset of the COVID-19 crisis in early 2020, stocks fell 33.8% but Bitcoin sank 38.1%, and in late 2018, when escalating trade tensions between the United States and China dragged equities down 19.36%, Bitcoin declined 37.22%. This track record had historically reinforced the notion that, when stocks took a hit, Bitcoin would invariably suffer a far steeper pullback.

In his latest note, Hougan emphasized how different the present situation feels. Instead of being battered well beyond the equity market’s turbulence, Bitcoin is now mirroring stock losses closely. He acknowledged that this alone does not make Bitcoin an unequivocal hedge asset, adding, “Critics will point out that matching stocks’ performance during a downturn is not the same as acting as a hedge asset, and that gold has been a better performer than Bitcoin during this pullback. That’s true.”

Nonetheless, he argued that Bitcoin’s ability to stay around the $80,000 mark while global markets churn is a testament to its robust staying power in the face of multiple macroeconomic shocks. “If that doesn’t give you confidence in its staying power, I don’t know what will,” he remarked.

Hougan’s view is that we are witnessing a transitional phase in Bitcoin’s evolution. He explained that the cryptocurrency has historically been driven by two competing forces: it has served as a risk asset, associated with significant upside potential and high volatility, yet it has also occasionally taken on the role of a hedge similar to gold.

In Bitcoin’s early days, the risk-asset angle tended to dominate; in major equity sell-offs, investors often shed Bitcoin faster and more aggressively than they exited stocks. Now, with more corporations integrating Bitcoin into their balance sheets, institutional investors exploring it as part of diversified portfolios, and governments—like the United States—incorporating it into strategic reserves, there appears to be a gradual tilt toward Bitcoin being treated more like “digital gold.” .

Still, Hougan warned that investors should not overlook the inherent unpredictability in the current macro environment. He noted that equity markets may not yet have found a bottom, raising the possibility that deeper slides could re-expose Bitcoin’s vulnerability if broader panic sets in.

He also conceded that gold’s performance remains a more classic example of a safe-haven behavior during systemic shocks, meaning Bitcoin has not conclusively demonstrated that it can replace traditional hedges during intense economic strain. Even so, in his words, “The world is unraveling, and Bitcoin is trading above $80,000.”

Hougan underscored that there is no guarantee this dynamic will endure, particularly given the unpredictable repercussions that could stem from sudden tariff escalations or shifts in monetary policy. As he concluded in his note, “Our baby is growing up as a macro asset. And that’s a beautiful thing to see.”

At press time, BTC traded at $85,200.

发表回复