Solana has returned to the spotlight as speculation around a potential Solana ETF approval gains momentum. While still unconfirmed, growing signals from market insiders suggest that regulatory green lights may not be far off. If approved, a Solana ETF would mark a major milestone for the ecosystem, opening the door to traditional capital flows and broader institutional exposure, similar to what Bitcoin and Ethereum experienced following their own ETF breakthroughs. For long-term investors, this development could set the foundation for a new phase of sustainable growth.

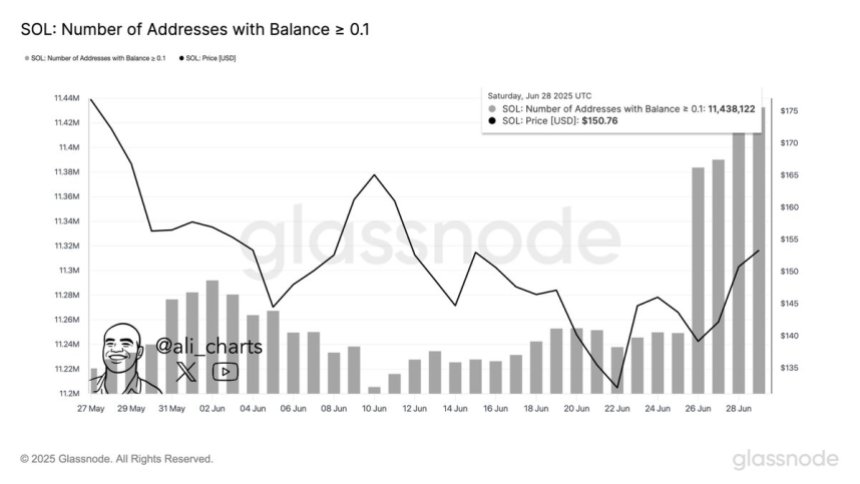

Supporting this bullish outlook is fresh data from Glassnode, which shows that the number of wallets holding over 0.1 SOL has reached a new all-time high. This milestone marks an increase in retail participation and growing confidence in Solana’s long-term potential. As the network continues to mature, the rise in small holders also signals expanding grassroots adoption—an encouraging sign during a period of market uncertainty.

While short-term price action may still be driven by broader macro trends, sentiment around Solana is clearly improving. If ETF approval becomes a reality, the combination of increased accessibility and rising on-chain adoption could significantly boost Solana’s market position in the coming months.

Solana Growing On-Chain Adoption

Solana is currently trading below the $150 mark after experiencing a sharp retracement from its May high. The asset has lost more than 20% in value since peaking earlier this cycle, driven largely by broader market consolidation and declining risk appetite across altcoins. Despite the recent pullback, SOL continues to hold a strong support zone near the $135–$140 range, which has proven resilient during previous sell-offs.

Analysts remain cautiously optimistic, noting that a sustained push above key supply zones—particularly the $155–$165 range—could reignite bullish momentum. However, the market remains in a phase of indecision. Price action across major assets, including Solana, reflects uncertainty as traders wait for a clear breakout or breakdown to confirm the next move. Without a strong catalyst, SOL may continue to consolidate alongside the broader altcoin market.

Amid the sideways price action, one encouraging signal is the growing on-chain adoption. Top analyst Ali Martinez shared data from Glassnode showing that the number of wallets holding over 0.1 SOL has reached a new all-time high, now exceeding 11.44 million. This steady rise in non-zero wallets points to expanding retail participation and long-term holder confidence, even as short-term volatility persists.

The divergence between price action and user adoption suggests that Solana’s fundamental growth remains intact. If momentum returns and macro conditions improve, Solana may be well-positioned for a breakout, especially with ETF rumors fueling speculative interest. For now, the $150 level remains a psychological pivot as the market watches for signs of direction.

SOL Price Action Details: Key Levels To Watch

Solana (SOL) is currently trading at $149.30, just below the key resistance confluence of the 50-day, 100-day, and 200-day moving averages, all clustered between $150 and $151. This area has acted as a strong technical barrier, and SOL’s repeated failure to reclaim it reflects the market’s hesitancy amid broader uncertainty. After rallying to $159.99 earlier in the session, bears stepped in and pushed the price back down, closing the candle with a bearish wick, signaling ongoing selling pressure.

The chart reveals a prolonged consolidation pattern that has developed since the mid-May rejection near $180. Despite several bounce attempts, SOL has not been able to regain bullish momentum. The volume profile also suggests fading interest during upswings, a common trait during accumulation or exhaustion phases. Notably, price remains above the March low, preserving a key higher low structure, which is crucial for the broader bullish outlook.

If SOL breaks above the $151–$155 range with sustained volume, it could trigger a move toward $180. However, failure to clear this resistance might lead to another test of support around $135. Traders should watch for a decisive close above the moving average cluster to confirm trend continuation, especially with ETF speculation fueling long-term optimism.

Featured image from Dall-E, chart from TradingView

Bir yanıt yazın