Bitcoin Magazine

How to Think About Bitcoin Treasury Companies: A Bitcoiner’s Dilemma in the Age of Rampant Speculation

Strategy, Michael Saylor and MSTR have taken over Wall Street. To many people’s chagrin, the suitcoiners and corporates are here: Bitcoin held by corporations in the form of bitcoin treasury companies is hypnotic to look at. It has captured more or less everyone’s mind — mine, included.

It’s the latest fad on the world’s capital markets, celebrated by a narrow sway of financially savvy Bitcoiners and insiders, yet hated by tradfi people who can’t for the love of humanity understand why anybody, let alone a company, would want bitcoin at all. Every odd Bitcoin podcaster has joined one or more bitcoin treasury companies as investors or advisors… or, to put their role more bluntly: as glorified marketers posing as retail-delivery systems.

Over the last few months, I’ve spent hundreds of hours investigating bitcoin treasury companies. I’ve read reports and explainers, bull-ish puff pieces and in-the-weeds descriptions. I’ve thought deeply about the financial-market logic behind them. I’ve edited excellent articles pushing the rationale for treasury companies, and overseen equally superb arguments contra them.

In some small ways, I’ve even fallen prey to them; I’m not as aggressively opposed to them as I gave voice to in the June 2025 article (“Are Bitcoin Treasury Companies Ponzi Schemes?”) that was, incidentally, shoved before Michael Saylor on Fox Business last week.

Here’s what I’ve learned from all of this.

What’s a Sane, Normal, Regular Bitcoiner To Do?

The easiest way to go about bitcoin treasuries and financialized bitcoin is to simply ignore everything. Before Enlightenment: chop wood, hodl self-custody bitcoin; after Enlightenment: chop wood, hodl self-custody bitcoin. Only time will tell if these financial vehicles, loaded with corporate-wrapped bitcoin and soft-spoken CEOs, will succeed or spectacularly blow up.

But in topics of money and finance (and economics more broadly), there is usually no nice, neutral choice, no non-action; my money and savings must go somewhere, my attention and labor be focused on something. New bitcoin treasury companies are launched weekly; aggressive fund raises or purchases are announced daily. Being in this space, having an opinion becomes inevitable; having a good, well-informed one seems almost a moral imperative.

Having spent years diving into the weeds of monetary economics, financial history and now the wild financial frontier of Bitcoin, the intellectual path to tread here is quite narrow. One side promises a fast-track to the hyperbitcoinized future we all envision, with corporate charters merely amplifying my sats on the way; the other, a cesspool of financial engineering and a hive of speculative mania quickly lining up Bitcoiners to have their fiat contributions repurposed as bitcoin yield.

Why Would a Bitcoiner Get Involved with These Companies?

One reason is leverage. As a typical millennial, I don’t have a house and thus no easy access to cheap debt (basically the only reason to own a home).

I can collateralize my coins via e.g., Firefish (at 6-9% APR), or draw on my credit cards (11% and 19%, respectively). Those terms aren’t great; they come with a hefty price tag, a pretty small capital pool and they’re not cheap. Even if bitcoin CAGRs at 30-60%, that’s over longer time periods — not monthly or annually, which is the cadence at which I have to service these types of debt.

In contrast, Strategy and MARA issue convertible debt at 0%. Those liabilities come due in a half-dozen years, and they’re in the nine-figure range. Said Pierre Rochard in debating Jim Chanos last month:

“The ability to access the terms that Saylor has… is not accessible to individuals holding Bitcoin in cold storage.”

For most Bitcoiners, getting in on this action is proving too juicy to resist… even if you need to fork over control and ownership, and additionally pay a hefty premium over their current bitcoin stash for the privilege of owning some of these shares.

As a leverage mechanism, Saylor’s turn into preferred shares seems much more expensive — paying 8-10% interest is approaching my own borrowing abilities — but they’re way safer.

The prefs safeguard the company itself, since they remove the risk of margin calls or debt-fuelled bankruptcy concerns, and give the company unprecedented flexibility. Preferred shares provide a release valve, since Strategy can opt not to pay the dividends for e.g., STRD; doing the same for STRF “only” costs them a 1% penalty going forward. In a pinch, and without much implication for the company itself, Strategy can even withhold payment for the others (at the risk of zeroing out the bondholder bagholder, and making plenty of people plenty angry).

Here’s the paradox: While this is financial leverage for Strategy, which gets more and more of other people’s money to plunge into bitcoin and top up their stash, it isn’t leverage for (new) shareholders of MSTR.

To invoke Jim Chanos’ answer to Rochard in that debate: the point of leverage is to have more than $1 of exposure. If I buy MSTR at mNAV 1.5, and Strategy itself has a leverage ratio of about 20%, I’m not levering up! (1/1.5 x 1.2 = 0.8). Thus, for every $1 I plunge into MSTR, I’m getting about 80 cents of bitcoin exposure. And the corporation, of which that share is a portion, still needs to pay about what I pay my financiers for the pleasure of using someone else’s money.

The calculations for most of the other treasury companies get even worse, mostly because of their excessive mNAV. You are the yield that the bitcoin treasury companies are chasing. When we invest in these companies, we play fiat games. And we play them directly in proportion to how expensive the mNAV is. I’ve asked many times:

“How can a bitcoin, wrapped in a corporate charter, suddenly be worth double, triple, or ten times the most liquid, observable and obviously indisputable price on the planet?”

Indeed,

“What extreme value-added transformation does our orange coin undergo the moment you take it under your financially leveraged wings and promise to issue debt, preferred stock, and equity against it — in “waves of credit bubbles,” we hear the ghost of Satoshi faintly whisper.“

Strategy’s great discovery — which everyone is now head-over-heels copying — is that wrapping a bitcoin in a corporate shell, smashing some leverage on top of it, and selling it on Wall Street somehow makes that same bitcoin worth multiples of its actual market price.

Much of the conversation ends there, with tradfi journalists busy dismissing this as a fad or a bubble; per the efficient market hypothesis, or just common sense, nothing should trade above the price of the only thing it holds.

Not enough. Let’s tally some quite sound reasons for why corporate stocks doing nothing but acquiring bitcoin ought to be worth more than the bitcoin they hold:

- Storage. Self custody is easier than you think, but plenty of people still shy away from it (see: ETFs). An additional weird reason is the high-profile wrench-attacks on Bitcoiners across the world; it’d be reasonable to pay some sort of premium for letting someone else store your coins. Can’t wrench-attack my MSTR shares. Saylor seems to know what he’s doing (though custodying with Coinbase has raised some eyebrows), so let’s “store” our bitcoin with his company. 10%.

- Futures. Future bitcoin is worth more than present bitcoin. At any given time, there are unannounced treasury company purchases accruing to shareholders but that aren’t yet public information. Whenever you purchase shares you’re only aware of the deals or acquisitions not yet made public… but we all know, and can predict, that shares should trade a little higher than they currently do: You’re always trading shares on present information, knowing full well that there are things behind the scenes resulting in more. That’s presumably worthy of some premium, so: 5% for e.g., Strategy; plenty more for the small and aggressive ones.

- Regulatory arbitrage. Look, says the bulls, there is all this money out there, desperate to buy bitcoin but just aren’t allowed to. I don’t quite believe that: Not that many people or institutions are keen on orange, and even if they were, whatever premium we wish to attach to this taxation-mandate-401(k)–regulatory hurdle, it’ll decay with time and adoption. The same financial incentives and laws of gravity that justify bitcoin treasury companies working at all also work to undermine the very regulatory obstacles that give them value in the first place. 20%.

(For some, such as Metaplanet in Japan, where bitcoin investors face excessive capital gains taxes, that arbitrage premium is worth more than that.) - Catch-all. I’m probably missing some additional reason — some of these companies have residual, real-world businesses too — for why a bag of bitcoin ought to be worth more than the bitcoin inside the bag… so let’s just add another 20% here.

Sum: 10+5+20+20 is 55… and conveniently about where MSTR traded when I first handwaved together these premium justifications. At a bitcoin price of $122,500, the 628,791 BTC on Strategy’s balance sheet is worth about $77 billion, but the market capitalization of the firm is $110 billion (~45% premium).

Strategy is a Bank: The Economic Vision

Not the kind that takes (bitcoin) deposits and issues (bitcoin) mortgages, but another, more deeply economic kind.

You can think of banking as one of society’s risk-sharing mechanism. Society advances loans to some risky ventures, and capital markets — of which the banking system is one part — distribute the levels of risk stemming from them. (A financial “Who Gets What and Why,” basically.)

A bank, economically speaking, is an institution that takes on that risk having some non-public information about the entities involved; it distributes a small, guaranteed return to the lender, while it, itself, gains from any successful venture — though not by as much as the equity owner themselves. If the bank does this successfully, i.e., it on average picks successful ventures and earns more in interest on credit-worthy loans than it pays on interest to depositors, it makes profits for itself.

This is what Strategy is doing, using the undiscovered zone between the bitcoin world and the fiat world.

Tradfi institutions, pension funds or retirees are the bank-financing component of the structure. They “deposit” money in Strategy, with returns and terms determined by the specific tranche they choose (STRK, STRD, STRF, STRC, or residual claimant in common stock, MSTR).

The bank invests these funds in assets: Strategy sits in the middle, guaranteeing the payouts to these economic entities by predicting that the assets will pay off more than the stated interest on the “bank deposits.” Rather than a bank lending on mortgages and credit cards and to small businesses, Strategy’s “lending” side consists of a single client: the world’s best-performing asset. What Strategy is doing is making the (very sensible) gamble that bitcoin will increase in dollar terms faster than the 8-10% it has to pay tradfi fiat institutions for the privilege of using their money.

Any middle-schooler with a calculator can figure out that infinite riches await if you’re borrowing at 10% per year to hold an asset that appreciates by 40% a year.

Naturally, bitcoin doesn’t do nice, comfy, 40%-a-year. If that were the case, per Michael Saylor’s own words, Warren Buffett would have snatched up aaaaall the bitcoinz long ago:

“If bitcoin was not volatile, people with more money than you, more power than you, would outbid you for the bitcoin; you couldn’t have it… At the point that it becomes completely predictable, Warren Buffet will say ‘oh yeah; we get it; we just bought all the bitcoin’… and your opportunity is gone.”

All that Strategy need to ensure is that the financing won’t bankrupt it; that the issuance is well under its control and discretion; that dividend payments are conservatively enough compared to the net capital it holds (i.e., bitcoin); and, most importantly, that the liabilities aren’t callable such that they’d force the company company to sell bitcoin at inopportune moments.

Basically, Saylor created a vehicle exceedingly suited to make his way through extreme downturns. Even 80% falls in bitcoin — the worst of its kind, and it’s certainly questionable whether those will ever happen again, given the size and public availability of the asset — won’t stifle the company. The key to a successful Ponzi is that the money must keep rolling in. More precisely, Strategy is conservatively Ponzi-like in its financing (unlike classic — fraudulent — Ponzis schemes, Saylor isn’t running a fraud; the optics just overlap, and nobody is defrauded… unwillingly, anyway).

What neither tradfi journalists nor treasury company-skeptic Bitcoiners have formulated well is how exactly these schemes fall apart. For “Economic Forces,” economist Josh Hendrickson outlines precisely the relevant stumbling blocks: “If markets are segmented and there is an expectation that the price will continue to experience rapid appreciation, this makes the present discounted value of a future liquidation could exceed the current liquidation value. If the stock is selling at its current liquidation value, it is underpriced.” And:

“what MicroStrategy has done is turn itself into a bitcoin bank by issuing dollar-denominated liabilities and purchasing bitcoin. The company is explicitly engaged in financial engineering to exploit regulatory arbitrage.”

Strategy’s model, but more so the other copy-cats given their respective jurisdictional moats, can thus break if:

- Investors are wrong about the future trajectory of bitcoin

- Whatever mandates, tax rules and legal obstacles that currently prevent investors from buying bitcoin directly loosen up

The flywheel effect, so imaginatively dubbed by the Twitteratis of the Bitcoin world, is the ability to exploit regulatory arbitrage, which, in turn, “is contingent upon investors maintaining this expectation that bitcoin is going to be worth considerably more in the future,” in Hendrickson’s very academic, economistic words.

Shareholders and buyers of the preferreds won’t be happy in the event of nonpayment of the dividend. Shareholders of MSTR itself will be unhappy if they’re diluted merely to satisfy bondholders (or worse, and Ponzi-like) pay the interest to preferreds. But so what? It doesn’t break Strategy.

What will break the model is the disappearance of these tradfi-to-bitcoin obstacles. It’s the regulatory hurdles that propelled so many of these companies forward; turned them to financial bridges between the new world and the old; made them vacuum up unproductive, low-yielding capital from all over the world and suck it into bitcoin.

If fund managers or treasury departments or family offices routinely stack bitcoin instead of various Strategy products (or securities of Strategy copy-cats, as the case may be in different parts of the world), the primary reason for bitcoin treasury companies go away.

The existence of bitcoin treasury companies, in short, hinges on the inertia of the present system. It depends, crucially, on family funds and pension funds, sovereign wealth funds and traditional investors not doing the hard work of figuring out actual bitcoin exposure (plus some safe, conservative leverage). If they don’t do that, and instead prefer to overpay 50% for the privilege, then… yes, the bitcoin treasury companies’ business models are forever sustainable.

What Else Can Go Wrong?

There’s a custodian risk for Strategy, certainly, with its coins with various custodians, and in solutions that are purposefully kept pretty opaque. What happens to Strategy’s business if e.g., Coinbase goes bankrupt? Or worse, new political winds bring in confiscation and/or aggressive taxation metrics?

Fair enough, these are tail risks but risks nonetheless.

And — it’s almost trivial to point this out — if Bitcoin somehow fails, obviously Strategy fails with it. If bitcoin stays a $118,000 stablecoin forever, most of Strategy’s opportunistic use of plentiful financial capital becomes almost moot, and it’ll trade like the pot of bitcoin most journalists and many analysts think it is, its extraordiary growth (mostly) evaporated.

And I think that’s what trips up so many journalists and analysts when looking at this treasury company phenomenon: If you can’t see how or why bitcoin would ever have value or use, let alone a place in the future of money and finance, then obviously a corporation devoted to acquiring as much bitcoina as it can makes no sense at all.

If you do see a use and future for bitcoin, its price ever-growing against an ever-declining fiat, a corporate vehicle dedicated to acquiring more by wielding capital markets money flows becomes a whole other proposition.

The Hedge and The FOMO: What If I’m Wrong?

Intellectual humility forces us to realize that maybe, just maybe, we got something wrong.

Diamond hands are continually forged… and mine remain pretty weak. It usually really troubles me when the bitcoin price drops precipitously. (It’s the sudden extreme of it, I believe, that’s a big deal… and I find it hard to account for it even in hindsight). I act recklessly, lash out — and not infrequently YOLO into lows with rent money or other pools of spare cash that really shouldn’t go into bitcoin.

In bull markets, that kind of behavior usually works to my benefit… but one day it won’t. Morgen Rochard, on one of these endless appearances on the Bitcoin podcast circuit, hammered home this point. (I sometimes say that Morgen has, paradoxically, convinced me to hold less bitcoin than I do… sleep calmly at night, be stoic in the face of price moves, etc, etc.)

The more I learn about Strategy, the more I’m warming up to its many specially catered products. It makes some semblance of sense for me to own e.g., STRC for short-term cash and STRK for muted bitcoin exposure with cash flow. STRK, financially speaking, is like holding bitcoin twice financially removed; short-term movements in short-term price would be much less extreme and it would pay me a bit of additional fiat side income.

Given that my net worth and professional engagements are mostly tied to bitcoin and correlated to bitcoin price, having slightly less of my net worth in this one-stop-shop area makes sense.

Why Not Just Hold Cash in a High-Yield Savings Account?

Good question. Two reasons: they don’t yield very much… checks notes… 4.05% on my “high-yield” dollar account. Saylor’s equivalent product, STRC, targets a rate hundreds of basis points above that; and STRK, which in the medium term approximates bitcoin itself, discounted or amplified by changes in MSTR’s mNAV (since at MSTR = $1,000, ten STRK converts), currently yields over 7%. Second, knowing myself, I’m pretty sure I’ll just plunge cash balances held in a fiat bank account into bitcoin at the first sign of a significant price dump; holding STRC or STRK in a brokerage account would at least raise the barriers to that sort of imprudent behavior.

Hedges… Hedges Everywhere

Since I’m already structurally short fiat — per the original Speculative Attack, I hold debt and bitcoin, so I’m leveraged long — it makes sense to… deep breath… diversify, just a little bit!

I already routinely max out the pension contribution that my jurisdiction local mafia already forces me to pay into. The funds inside that permissioned wrapper invest broadly in stocks and bonds (roughly 75:25 proportion); compared to any sort of bitcoin comparison, these of course perform awfully, but in case I’m somehow — for some unimaginable reason — wrong about this whole money-printing, central banking-end-of-an-era thing, at least I won’t starve in old age:

Second, contributing to it comes with massive tax perks: Maxing out the contribution gives me some 1.5x the money right off the bat. While those additional funds will be outgrown by bitcoin’s routine ~40% CAGR in less than two years, they also come with tax-free mortgage perks; should I want to get myself a house real-world shitcoin someday, I can use this pot of money for the occasion.

The bitcoin-opportunity cost is real, and over time quite debilitating, but this isn’t a matter of conviction. Real-world practicalities rule: It makes a world of difference for how you live your life if hyperbitcoinization happens in a week or in a hundred years.

What has any of this got to do with bitcoin treasury companies?!

Plenty: because the hedging mentality of “what if I’m wrong about this” prevails here as well.

For all the fluff and fancy verbiage, all the new metrics and futuristic moon dreams, I still can’t get past why a bitcoin when wrapped in a corporate charter should be worth more than a bitcoin. Yes, yes, net-present-value of future growth, yield, capital arbitrage, speculative attack, and bet on hyperbitcoinized banking but… really?!

OK, so what if I’m wrong? Plenty of people I trust in the Bitcoin space vouch for these things — more by the minute, it feels like — and there is some logic to them. Cheap leverage, speculative attack, tapping into (read: tricking) fiat pools of money to flow into bitcoin.

…so I FOMO’d into two treasury companies recently: Two Strategy products (MSTR and STRK) and the Swedish small newcomer H100.

It’s Nice to Have Stocks Again…

A decade or more ago, I used to hold plenty of stocks — large, well-diversified portfolios, meticulously tracked. For years now, and for obvious reasons, I haven’t held any.

I decided on Strategy’s stuff because they are the least financially insane in this space; the second one because I had easy access via my old-time Nordic bank accounts — and I wasn’t going to bother with finding a convenient brokerage, sign papers and transfer funds, in order to maybe play with a few hundred bucks of bitcoin treasury funds. There’s enough ridiculous paperwork in the world.

On the off chance that these things amount to anything, Strategy will be there, running the show: MSTR is “amplified bitcoin,” as their marketing says. Since most of my savings are orange-clad and my professional life is deep orange, once more, that sort of diversification makes sense. (Plus, the mNAV for MSTR is quickly approaching one… 1.42 as I’m writing this.)

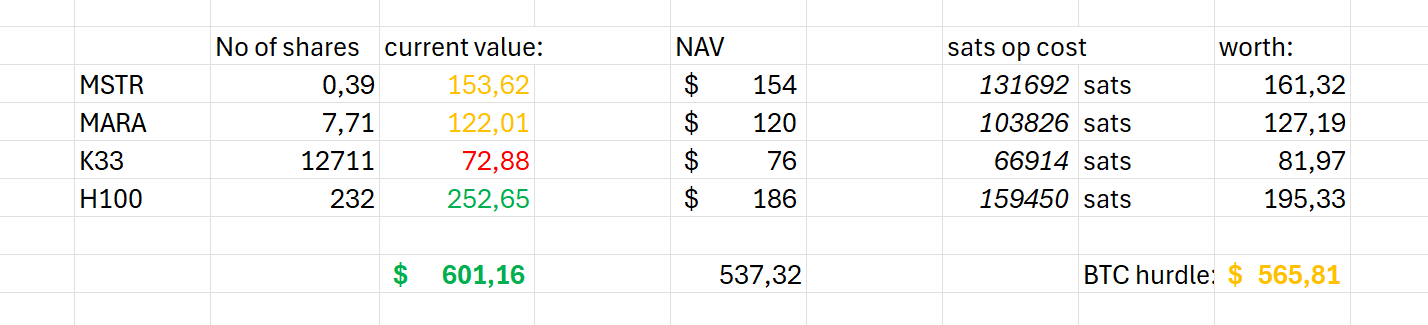

With Emil Sandstedt’s words ring in my ears — I understand that I am the BTC yield they’re after — but at 25%-ish BTC yield and 20% (safe) leverage via the prefs and convertibles, I’ll be back at even exposure about this time next year: My ~150 dollars’ worth of MSTR shares currently provide about 120 dollars’ worth of bitcoin exposure; I’m happy to throw in the extra $30 bucks for the financial empire Mr. Saylor is erecting (and the potential growth in bitcoin-per-share).

Second, H100. The mNAV here was also pretty acceptable for a small, nimbly, fast-moving and uniquely jurisdictionally dominant player — at 2.73, ugh — but its low days-to-cover rate makes me feel that I won’t get too shafted.

My first realization after buying some: I’d forgotten how much fun it is!

Suddenly, I’m tracking several different asset prices instead of just one. Suddenly, I’m financially in cahoots with real companies doing real things (…ish, anyway), rather than just the most portable, global and easily accessible money there ever was. Psychologically, I felt part of something — vested in the venture, the speculative attack and bitcoin yield-curve construction project that is treasury companies. How exciting!

Second realization: Bitcoin has messed with clarified the meaning of ownership.

None of these instruments are mine; they’re wrapped in layers of permissioned custody. I can sell them at the press of a button (from nine to five, Mondays through Fridays…), but I only ever see any of that value if

a) the brokerage cooperates

b) the bank that receives the payout cooperates, and

c) the government doesn’t block the transactions.

It is one step worse than what Knut Svanholm elegantly remarks on em Bitcoin: The Inverse of Clown World:

“A bank is akin to a 2-of-3 multi-sig wallet where you, the bank, and the government hold one key each. In other words, money in the bank is not really yours. Nor is it really money at all.”

…Or Not So Nice to Have Stonks

I quickly got myself a few reminders of the intransparent, altogether ridiculous and bureaucratic nightmare stock “ownership” is. After I had transferred funds to the brokerage last month, found STRK and pressed “buy,” I received an error message: “This security is not available to you.”

Turns out I wasn’t eligible to own American securities through that brokerage.

Tradfi assets are so intransparent and so darn permissioned. And the reminders of this obsolete value-technology kept coming. Obviously, it took a day or two for that “investment” to go -11%, reminding me that I still know nothing about fair valuation or timing the market. (Then again, bitcoin puked off 5% from its then 2-week 118,000 stablecoin pattern, so the opportunity cost was somewhat muted.)

It got worse when trudging through the lower-level sludge of bitcoin treasury companies: the two Swedish penny stocks that have made noise (H100, and K33; I had to buy something with the money intended for STRK) instantly fell 10% and 20% respectively — basically from the moment I touched them. Some experiment.

To paraphrase an old Wall Street adage, an idiot and his sats are soon separated… and the present idiot doesn’t even have any new, shiny things to show for it because — newsflash! — stocks are custodial and immaterial! They reside in a brokerage firm’s database, and by extension, a company ledger somewhere. They’re not physical… and they’re not even really mine! I can’t spend them, move them, back them up or recover them to a different wallet. They’re stuck where they are, dead stock in Adam Smith’s famous phrasing regarding money.

Instead, I set aside some other fiat funds in my regular banking app and impulse-bought MARA (MSTR is available there, but no other Strategy instruments); while MARA is issuing stocks and convertible debt to stack sats like yet another treasury company, at least it’s an underlying operating business (mining) — and their mNAV is around 1, so I don’t pay a premium for their financial-market, cost-of-capital arbitrage-ish play.

How, Just HOW, will Bitcoin Treasury Companies Fail?

“There’s a real possibility we have, like, a dot-com style boom-and-bust cycle in this public equity world.”

Danny Knowles, May 28, “What Bitcoin Did”

Strategy is bulletproof.

As Lyn Alden’s question in the Strategy Q2 earnings call illustrated, even in an 80% bitcoin drawdown, Strategy will be fine. The company was in a much worse position during the 2022 bear market when its bitcoin was directly tied to margin loans and collateral for bank debt. That’s not the case in 2025 when preferreds run the show.

Looking past the occasional tradfi analyst or journalist obsession with mNAV, or why a company should be valued above the bitcoin it holds, and the pearl-clutching, inside and outside Bitcoin over using debt for acquiring more bitcoin, Strategy is unbelievably conservatively financed. The company holds bitcoin worth some $77 billion; the convertible debt amounts to about $5 billion ($8 billion, really, but some of them are deep in the money and trade as equity, not debt, at this point). There’s a little over $6 billion of preferred stock outstanding across STRK, STRD, STRF and STRC. (That makes the company about 15% levered, meaning bitcoin would have to drop by over 85% for the company to have any sort of solvency problems.)

Another avenue for problems is if tradfi money market capital dries up. Strategy’s ability to overperform bitcoin by generating increasing bitcoin per share depends on some combination of lower/safer cost of capital (or better terms on its debt) or tapping the above-1 mNAV (instantly accretive since it lets Saylor buy bitcoin at discount). In the absence of that — say, nobody buys the treasury company issuances, and financial capital flows somewhere else; money printing stops; interest rates on (safer?) government securities shoot up, etc — I don’t see how Strategy’s mNAV doesn’t just collapse back down to 1.

Lastly, there’s a custodian risk for Strategy specifically. Being the biggest player around, with some 3% of the total supply, honey-pot risks abound. (This probably won’t be an issue for the smaller ones, distributed across very different jurisdictions.) Strategy keeps its gigantic pile of coins with Coinbase custody — in solutions that are purposefully kept pretty opaque.

What happens to Strategy’s business if Coinbase goes bankrupt? Or worse, new political winds bring in confiscation and/or aggressive taxation metrics? These are good questions, but very out-there tail risks nonetheless. Do we really have to worry that much about them?

Whether bitcoin treasury companies are here to bring bitcoin to the center of global capital markets, or whether this all ends in disaster, we have yet to see.

Closing Thoughts: Sell-Out? Ponzi Got to Your Head?

Have I intellectually sold out? Am I a corporate slave? Has David Bailey’s musings — and the fact that Nakamoto, loosely affiliated with Bitcoin Magazine via shared ownership and marketing services — rubbed off on me, now that NAKA is merging with KindlyMD and can unleash its flywheel/“Ponzi” scheming in full?

First, it would be a deep betrayal of journalistic integrity and — tells me our in-house legal counsel — illegal to use a media platform to pump securities owned by its owner. (Though in the age of Trump, who can tell?). But I certainly wouldn’t be doing my job if I weren’t seriously investigating the pros and cons of these entities mushrooming up everywhere.

Second, and as an illustration of my very low conviction in all of this: I hold about as much in treasury company stocks as I do in custodial Lightning wallets for zapping and convenience spending — ergo, not much.

Third, for full transparency (again, on advice of counsel), here’s the experience detailed to date (note: calculated at prices before Treasury Secretary Scott Bessent’s comments yesterday shoved all these prices downward):

A few things stand out.

- Choose your bitcoin treasury companies carefully: H100 and Sander Andersen seem pretty dedicated to the stacking effort, and the company keeps moving up the bitcoin treasuries list. For now, financial markets reward such companies for their efforts. In contrast, the K33 team moves much slower, and their share price experience since their first bitcoin launch months ago has been classic, short-term pump before gradually declining back to where the stock started. MARA and Strategy are hovering around where they have been for months.

- My amazing ~5% excess return over bitcoin is too meagre to bother with — and one-off lucky. Over longer time periods, this might change… but honestly, just don’t bother.

- I will probably get tired of this latest fiat financial engineering fad soon enough. It’s only so much fun to hold permissioned, brokerage-limited, old school assets.

Come hell or high water, celebration or disaster, glory or tears… it seems much easier to just keep chopping wood and stacking sats into cold storage than to bother with any of these bitcoin securities.

Treasury fever is running high on Wall Street and among hyped-up Bitcoiners. Maybe the financialization of bitcoin is upon us… but honestly, I think I’ll mostly just sit this one out.

-

BM Big Reads are weekly, in-depth articles on some current topic relevant to Bitcoin and Bitcoiners. Opinions expressed are those of the authors and do not necessarily reflect those of BTC Inc or Bitcoin Magazine. If you have a submission you think fits the model, feel free to reach out at editor[at]bitcoinmagazine.com.

The opinions expressed in this article are the author’s alone and do not necessarily reflect the opinions of BTC Inc, BTC Media, Bitcoin Magazine or its staff. The article is provided for informational purposes only and should not be considered financial, legal or professional advice. No material non-public information was used in writing this article. Opinions, and financial actions taken as a consequence of those opinions, are those of the author’s and do not necessarily reflect BTC Inc, BTC Media, or Bitcoin Magazine.

Nakamoto has a marketing partnership with Bitcoin Magazine’s parent company BTC Inc to help build the first global network of Bitcoin treasury companies, where BTC Inc provides certain marketing services to Nakamoto. More information on this can be found here.

This post How to Think About Bitcoin Treasury Companies: A Bitcoiner’s Dilemma in the Age of Rampant Speculation first appeared on Bitcoin Magazine and is written by Joakim Book.

Deixe um comentário