As Bitcoin (BTC) consolidates just below the $120,000 mark, concerns are mounting over whether the top cryptocurrency’s bullish momentum is fading. However, some analysts believe BTC still has room to grow, citing key on-chain indicators.

Bitcoin Rally Far From Over

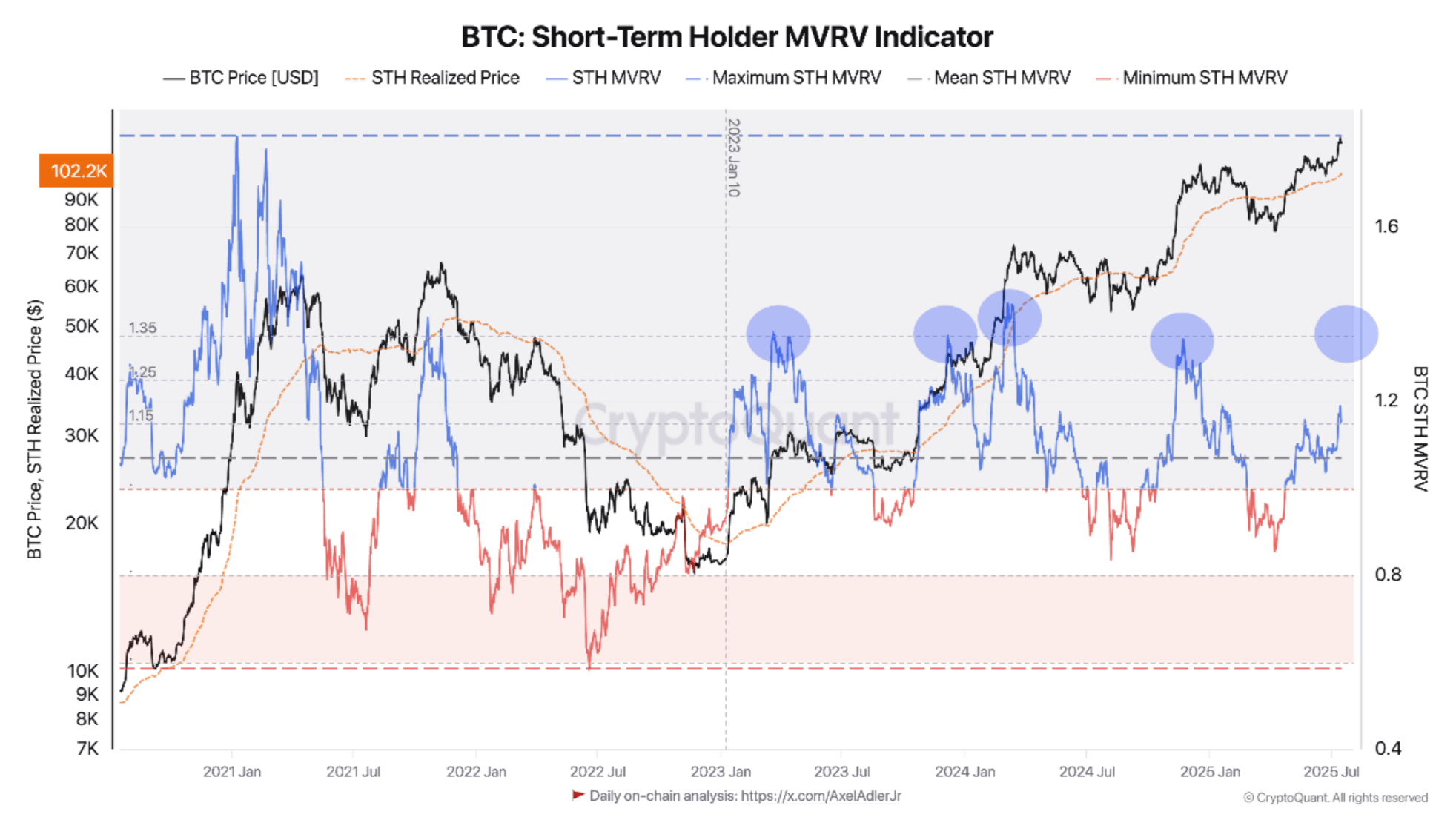

According to a recent CryptoQuant Quicktake post by contributor Darkfost, Bitcoin’s rally is not yet over. The analyst points to the Short-Term Holder (STH) Market Value to Realized Value (MVRV) indicator as evidence.

For context, STH MVRV measures the profitability of Bitcoin held by short-term investors – typically those who acquired BTC within the last 155 days – by comparing the current market price to their average purchase price.

When the STH MVRV is high, it suggests short-term holders are in profit and may sell. On the contrary, a low or negative MVRV indicates undervaluation and potential for further upside.

Darkfost noted that during the current market cycle, unrealized profits among STH have yet to surpass the 42% threshold. Historically, every time the STH MVRV reaches around 1.35 – implying a 35% unrealized profit – it has triggered a wave of profit-taking, followed by short-term price pullbacks.

As of now, the STH MVRV stands at approximately 1.15, well below the profit-taking zone. The analyst attributes this to the STH realized price exceeding $100,000 for the first time in Bitcoin’s history on July 11. At the time of writing, this realized price has risen above $102,000, providing BTC with a robust support base.

To clarify, STH realized price refers to the average price at which all Bitcoin held by short-term holders was acquired. When Bitcoin’s current market price remains above this level, it reflects growing market confidence among newer investors.

Darkfost added that BTC could rise another 20–25% before the STH MVRV reaches its critical level again. If this projection holds, Bitcoin could potentially hit $150,000 before the next wave of widespread profit-taking.

Fresh Liquidity May Help, But Exercise Caution

Bitcoin may also benefit from fresh liquidity entering the market. Fellow CryptoQuant analyst Amr Taha recently highlighted a $2 billion USDT deposit into major derivatives trading platforms, signaling potential leverage buildup.

Similarly, favorable macroeconomic conditions are expected to support risk-on assets like Bitcoin. The recent weakness in the USD has fuelled optimism around capital rotating into cryptocurrencies and other high risk-reward assets.

However, BTC inflows to centralized exchanges have been steadily rising as well, suggesting a short-term correction could be on the horizon. At press time, BTC trades at $118,862, down 0.2% in the past 24 hours.

Parašykite komentarą