Solana is trading at critical levels after several days of trying to decisively break above the key $155–$160 resistance zone. Bulls are slowly building momentum, as the broader crypto market shows signs of strength and hints at the possibility of a sustained rally. However, global risks remain elevated, particularly as no clear resolution has been reached in the ongoing US-China trade conflict, which continues to shape macroeconomic sentiment and investor behavior.

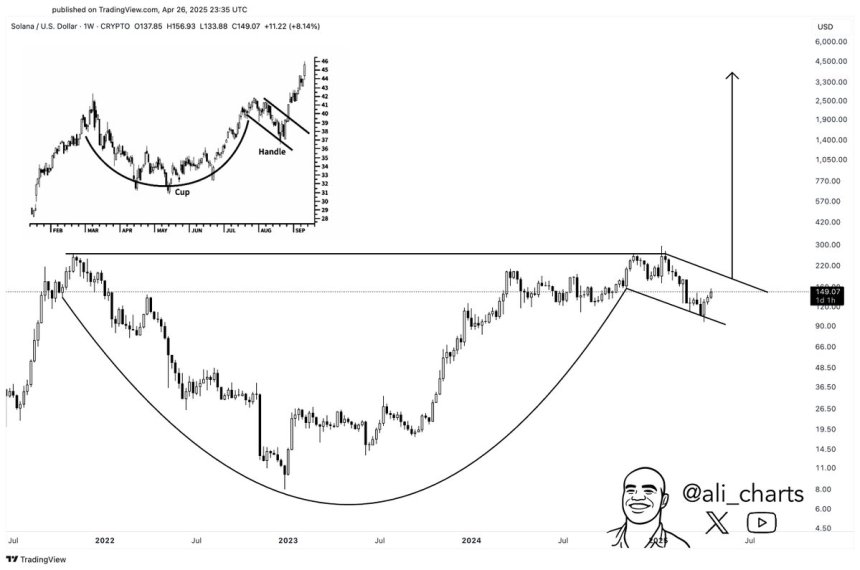

Despite the uncertain backdrop, technical indicators are beginning to favor a bullish outlook for Solana. Top analyst Ali Martinez shared new insights, highlighting that when zooming out, Solana appears to be forming a textbook-perfect cup and handle pattern — a classic technical setup typically associated with major bullish breakouts. If validated, this pattern could set the stage for a strong upside move in the coming weeks.

Still, caution is warranted, as broader market volatility and unresolved geopolitical tensions could disrupt the developing momentum. The next few days will be pivotal for Solana’s trend, as bulls must defend key levels and build enough pressure to attempt a true breakout above resistance.

Solana Shows Strength Amid Shifting Market Dynamics

Solana is up 58% since early April, showing impressive recovery momentum as market dynamics start to shift. After months of weakness and selling pressure, Solana is now emerging as one of the stronger performers among major altcoins. Analysts are closely watching the $160 level, with many calling for a decisive breakout that could unlock further gains. However, risks remain elevated. The broader macroeconomic environment remains unstable, with global trade conflicts and financial market volatility weighing on investor sentiment.

Solana has been particularly sensitive to this uncertainty. Since January, SOL lost over 65% of its value, highlighting the growing selling pressure and speculative behavior that dominated the market during the first quarter of 2025. Despite this, the recent surge has shifted short-term momentum back in favor of the bulls, offering hope for a broader recovery if key levels are reclaimed.

Martinez’s analysis supports a bullish outlook for Solana. He points out that zooming out reveals Solana is forming a textbook-perfect cup and handle pattern. This classic technical structure often precedes strong upward movements, especially when accompanied by growing volume and supportive macro conditions. If confirmed, this setup could mark the beginning of a major rally for SOL in the weeks ahead.

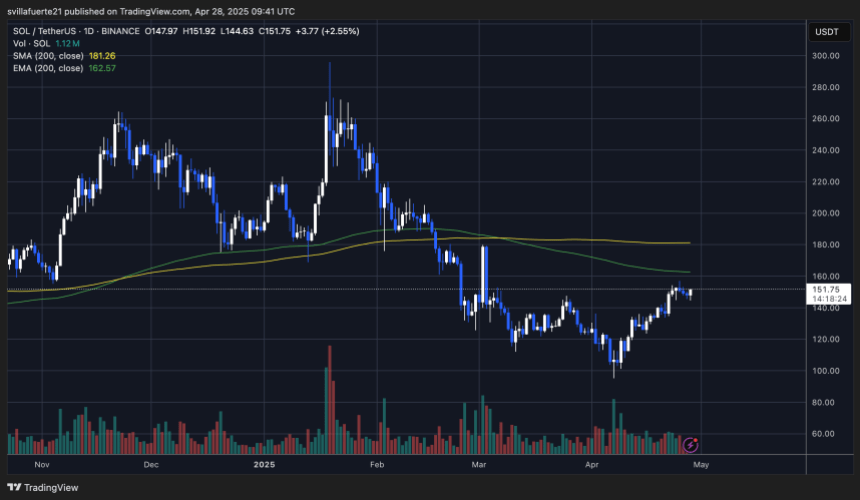

SOL Price Action Remains Tight Below Key Resistance

Solana (SOL) is trading at $151 after several days of consolidation below the crucial $160 resistance zone. Bulls have managed to defend recent gains, but momentum has slowed as the price struggles to push higher. Reclaiming the $160 level is essential for bulls to regain full control and continue the recovery. A clean breakout above $160 could trigger a rally toward the $180 mark, which aligns with the 200-day moving average (MA) — a critical technical barrier that, if flipped into support, would confirm a strong trend reversal.

However, risks remain elevated if bulls fail to reclaim the $160 resistance soon. A failure at this zone could expose SOL to a deeper correction, potentially dragging the price back toward the $120–$100 support area. This would not only erase recent gains but could also damage market sentiment, slowing Solana’s recovery efforts.

For now, consolidation just below resistance suggests that buyers are attempting to build strength. However, the next few days will be critical to determine whether SOL can break higher or enter another corrective phase. All eyes remain on the $160 breakout level as the battle between bulls and bears intensifies.

Featured image from Dall-E, chart from TradingView

답글 남기기