After falling below a crucial support level, Bitcoin (BTC) is attempting to recover some of its lost ground. An analyst suggested that this week’s performance will be decisive for the cryptocurrency’s next trend.

Bitcoin Loses Bull Flag Formation

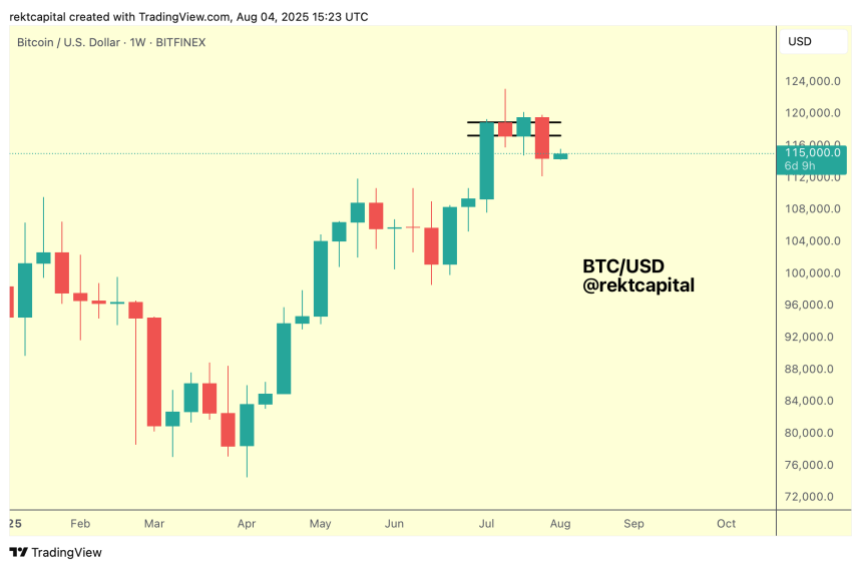

Over the weekend, Bitcoin lost its post-breakout range for the first time in three weeks, falling to a local low of $112,296 on August 3. The flagship crypto had been trading between the $114,000-$120,000 range since the early July breakout, hitting its all-time high (ATH) of $122,838 amid the rally.

As July neared its end, BTC experienced some volatility, retesting the range lows twice over its last week. However, the cryptocurrency was unable to repeat its price recovery from the previous weekend, losing the crucial area on August 1.

Rekt Capital noted that Bitcoin’s rally could be at risk, explaining that BTC has formed a bull flag in the weekly chart and held the pattern’s lows as support until the latest Weekly Close.

Following its recent price action, the analyst considers that this week’s performance will be pivotal to see whether the pattern’s bottom, around the $117,200 area, will become a new resistance and confirm the breakdown, or if the flagship crypto’s price will recover the structure.

According to the analysis, if the price can reclaim the structure, the correction would be considered a fake downside deviation before resynchronizing with the pattern.

Meanwhile, turning the pattern’s bottom into resistance would be a bearish retest, confirming the breakdown, and potentially leading to a new retest of the $112,000 area as support.

BTC’s Weekly Close To Determine Next Trend

Rekt Capital also detailed that this week’s performance will determine the future of BTC’s second Price Discovery uptrend, which has technically started its fifth week.

Depending on what happens to the Bull Flag (reclaim or a confirmation of the breakdown), we will know whether the Price Discovery Uptrend 2 will continue or whether BTC has experienced a very short PDU2 instead.

Last week, the analyst retesting that the continuation of the Price Discovery trend could fail as BTC transitioned into weeks 5-7 of this phase. Historically, the second uptrend has started to slow down around Weeks 5-6, hitting its peak during this “Danger Zone.”

If Bitcoin reclaims the Bull Flag and challenges new highs, then its second Price Discovery uptrend will progress according to its historical tendencies.

However, if it fails to Weekly Close above the pattern’s bottom and confirms additional downside, the second Price Discovery uptrend would have ended in Week 2, much quicker than has historically been the case.

Moreover, it would reveal that BTC has been in its second Price Discovery Correction, which “would be going completely against the grain of history.”

The analyst suggested that macro-wise, Bitcoin still has plenty of time for a third Price Discovery uptrend. If the second phase has already ended, a final uptrend could overcompensate for the current uptrend’s underperformance.

Previously, Rekt Capital asserted that what comes after the second uptrend would depend on how long the corrective phase takes, as a shot correction could allow for a third uptrend before the bear market.

답글 남기기