Ethereum’s price action may have struggled to gain traction in recent weeks, but an interesting long-term macro indicator is showing signs of early recovery beneath the surface. Particularly, a macro trend oscillator created by a crypto analyst known as Decode on social media platform X has begun to exhibit signs of a turnaround after an unusually prolonged stretch of bearish run. If confirmed, this would mark the beginning of a new phase of strength for the second-largest cryptocurrency by market cap.

Shallow Red Bars Begin Turning On Ethereum’s Multi-Timeframe Trend Analysis

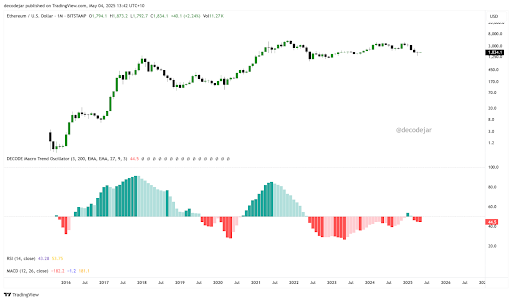

The oscillator’s monthly chart, overlaid with Ethereum’s price data on the monthly candlestick timeframe, clearly shows how deep and sustained the recent bearish momentum has been. The red histogram bars reflecting macro weakness persisted well beyond typical durations, highlighting the broader economic drag that has weighed on the crypto market.

Interestingly, January of this year briefly hinted at a return to bullish territory, but the green print turned out to be a false start and quickly faded as the cryptocurrency kicked off another downturn. However, the magnitude of recent red bars is notably shallower compared to downturns in 2023 and 2024.

This subtle shift is more apparent on the lower timeframes, particularly the 3-day chart, which shows a clean rejection from the negative territory and the formation of a small green bar before the current pullback. The analyst, Decode, interprets this as a possible early-stage turnaround. Once the oscillator turns green in a sustained fashion, a rapid upward move in Ethereum and broader crypto prices is likely to follow, following similar transitions in the past.

Green Phase Will Dominate Soon

Looking beyond crypto, Decode’s oscillator also tracks the S&P 500 and broader macro trends, where the same pattern holds: green phases are not only more prolonged but also steeper and more robust. This asymmetric distribution of momentum across time reflects the true bias of assets toward expansion over contraction. Decode noted that this is not merely an indicator with arbitrary thresholds but a fully integrated macroeconomic index built from 17 metrics. These include equities, bonds, commodities, currency flows, central bank liquidity (M2), and even sentiment data.

Translating this into Ethereum, this gradual shift toward the green zone is seen as a signal of incoming price strength. Although Ethereum has yet to fully recover from its recent correction to $1,400, the subtle but consistent improvement in Decode’s macro trend oscillator hints that the cryptocurrency may be entering into a fresh uptrend. Right now, the focus is on green bars printing consistently again, especially across multiple timeframes.

At the time of writing, Ethereum is trading at $1,830. The last 24 hours have been marked by a brief break below $1,800 before bouncing at $1,785. This move caused liquidations of approximately $35.92 million in ETH positions, with long positions accounting for $28.38 million of that amount.

답글 남기기