Bitcoin is trading around $107,000 after its recent flash crash, maintaining stability to prevent further decline but is yet to return to trading above $110,000. Notably, popular crypto analyst Titan of Crypto shared a detailed Gaussian Channel analysis on X that points to Bitcoin’s macro bull structure remaining intact despite short-term volatility. His post, which was accompanied by a Bitcoin price chart, shows how Bitcoin’s position relative to the Gaussian Channel offers a clear view of the ongoing cycle.

Bull Market Intact Above Gaussian Channel

Titan of Crypto noted that Bitcoin’s placement above the Gaussian Channel represents strength in the long-term trend. As shown in the weekly candlestick price chart below, the green channel corresponds to bullish phases, while red regions represent bearish downturns, a prime example being the 2022 bear market.

At the time of writing, the upper band is positioned around $101,300 and trending upward. Therefore, Bitcoin’s price action around $107,000 means that it is yet to break into the Gaussian channel and its overall market structure is still solid. From this, it can be inferred that Bitcoin’s current pullback from the October 6 all-time high above $126,000 is only a temporary pause within a larger bull market.

Bitcoin Gaussian Channel. Source: Titan of Crypto on X

However, although the Gaussian Channel reading looks favorable, Titan of Crypto noted that the indicator should not be treated as a trading trigger. “It’s not a buy signal, it’s a macro context indicator,” he stated. Being above the Gaussian Channel doesn’t necessarily equate to buying more. It simply means the bull market structure is still intact.

The Gaussian Channel works best when combined with other indicators such as trading volume, moving averages, and on-chain accumulation trends to confirm directional momentum.

Coinbase Premium Gap Turns Red

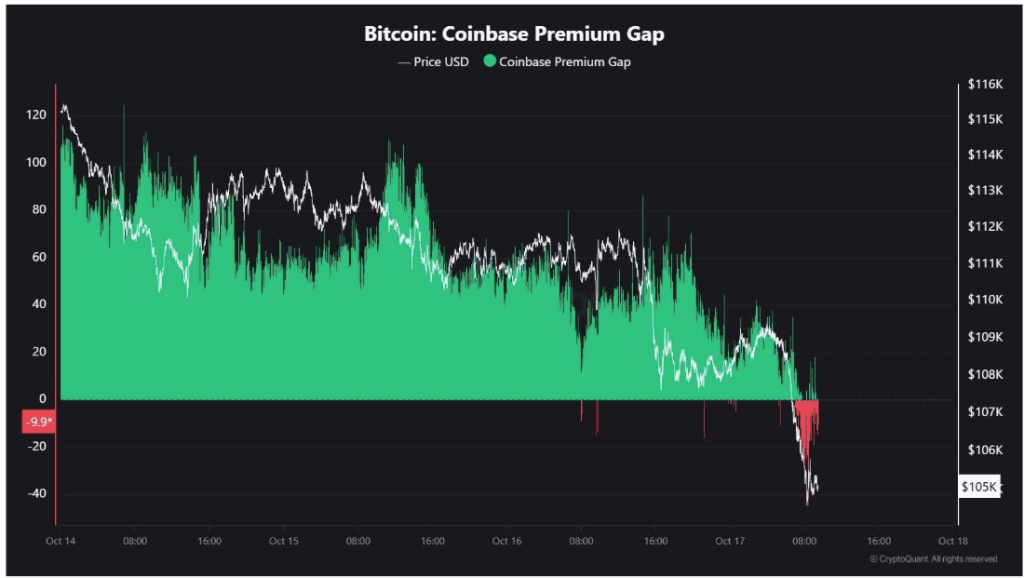

Speaking of other indicators, on-chain data from CryptoQuant shows that the Coinbase Premium Gap, a metric comparing Bitcoin’s price on Coinbase versus other exchanges, has turned red. As shown in the chart below, Coinbase’s Premium Gap went on a sharp decline from positive premium levels above +60 earlier in the week to as low as -40 when the Bitcoin price fell to $101,000.

Interestingly, the Coinbase Premium Gap has increased to around -10 at the time of writing, meaning US investors are starting to turn bullish again. This can be seen as a bullish signal, as similar dips in US demand were recorded between March and April before the Bitcoin price eventually rallied more than 60% to reach new all-time highs.

However, a red Coinbase Premium Gap alone is not decisive. It should be interpreted alongside other data points, including ETF inflows, trading volume, liquidity, and derivatives funding rates. At the time of writing, Bitcoin was trading at $107,120.

Featured image from Vecteezy, chart from TradingView

답글 남기기