Solana is once again in the spotlight. Blockchain data by Arkham Intelligence shows that an Alameda Research staking account has unstaked $35 million worth of SOL. Alameda Research initially locked up the SOL in late 2020. A convicted fraudster, Sam Bankman-Fried, founded Alameda Research, once a prominent quantitative cryptocurrency trading firm and the sister company of the now-defunct FTX exchange.

The connection instantly raises eyebrows, given the firm’s infamous collapse in late 2022. At the time, both Alameda and FTX were forced into bankruptcy following revelations of fraudulent practices, including the misuse of billions in FTX customer funds. These events marked one of the largest scandals in crypto history, sending shockwaves through the industry and prompting years of legal proceedings and asset recovery efforts.

The recent unstaking has fueled speculation among traders and analysts, with some viewing it as a potential signal of forthcoming market activity involving SOL. While the transfer does not necessarily imply an immediate sale, the movement of such a substantial amount could influence short-term price dynamics and sentiment.

Alameda Research SOL Unstake Raises Questions

According to blockchain analytics platform Arkham Intelligence, the $35 million worth of Solana recently unstaked from an Alameda Research account had an initial value of just $350,000 when it was locked in late 2020 — a remarkable 100x increase. This staggering growth in value underscores Solana’s meteoric rise over the past few years. Arkham raises an important question: Will these funds finally be returned to FTX creditors? While the answer remains uncertain, the move suggests that some activity is underway in the ongoing recovery and redistribution process tied to Alameda’s bankruptcy.

From a price action perspective, Solana has been consolidating below the $200 level since February, unable to break through this key resistance despite maintaining strong network activity. The sideways trend has kept SOL relatively quiet compared to other major cryptocurrencies. When compared with Ethereum, the contrast is notable — Ethereum has seen stronger price momentum recently, leading some analysts to call the current market phase “Ethereum season.”

However, others argue that Solana’s quiet phase may be setting the stage for a breakout. Historically, large-cap altcoins like SOL often follow in the wake of Ethereum rallies, catching momentum once ETH’s surge begins to cool.

Solana Consolidates Below Key Resistance

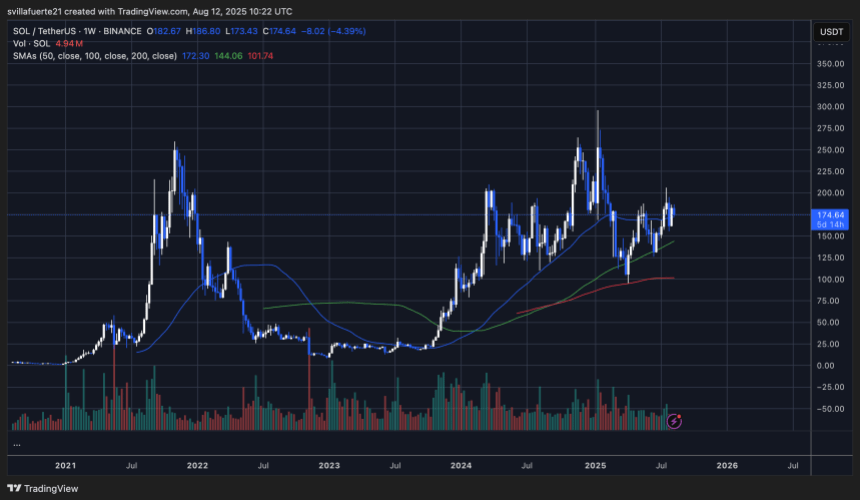

On the weekly chart, Solana (SOL) is trading at $174.64, down 4.39% in the latest session, as it continues a multi-month consolidation phase below the critical $200 resistance level. Since February 2025, SOL has repeatedly tested this psychological barrier without securing a sustained breakout, highlighting strong selling pressure at higher levels.

The 50-week simple moving average (SMA) at $172.30 is acting as immediate dynamic support, with the 100-week SMA ($144.06) and 200-week SMA ($101.74) positioned well below, reflecting a still-healthy longer-term uptrend. The current price structure shows SOL holding above both the 50-week and 100-week SMAs, a bullish signal that suggests buyers remain in control despite recent pullbacks.

However, trading volumes have not matched the peaks seen during prior rallies, indicating a more cautious market tone. A decisive breakout above $200 would likely open the door to retests of the $250–$260 zone, while failure to clear resistance could extend the consolidation or lead to a retracement toward the 100-week SMA.

Featured image from Dall-E, chart from TradingView

답글 남기기