Yesterday, Bitcoin (BTC) made a fresh all-time high (ATH) of $111,880 on Binance crypto exchange following months of downward action during the first quarter of the year. The leading cryptocurrency has rebounded over 45% from its April 6 low of approximately $76,000, and recent whale behavior suggests that long-term holders see further upside potential.

Bitcoin ATH Sees Mixed Reaction From Whales

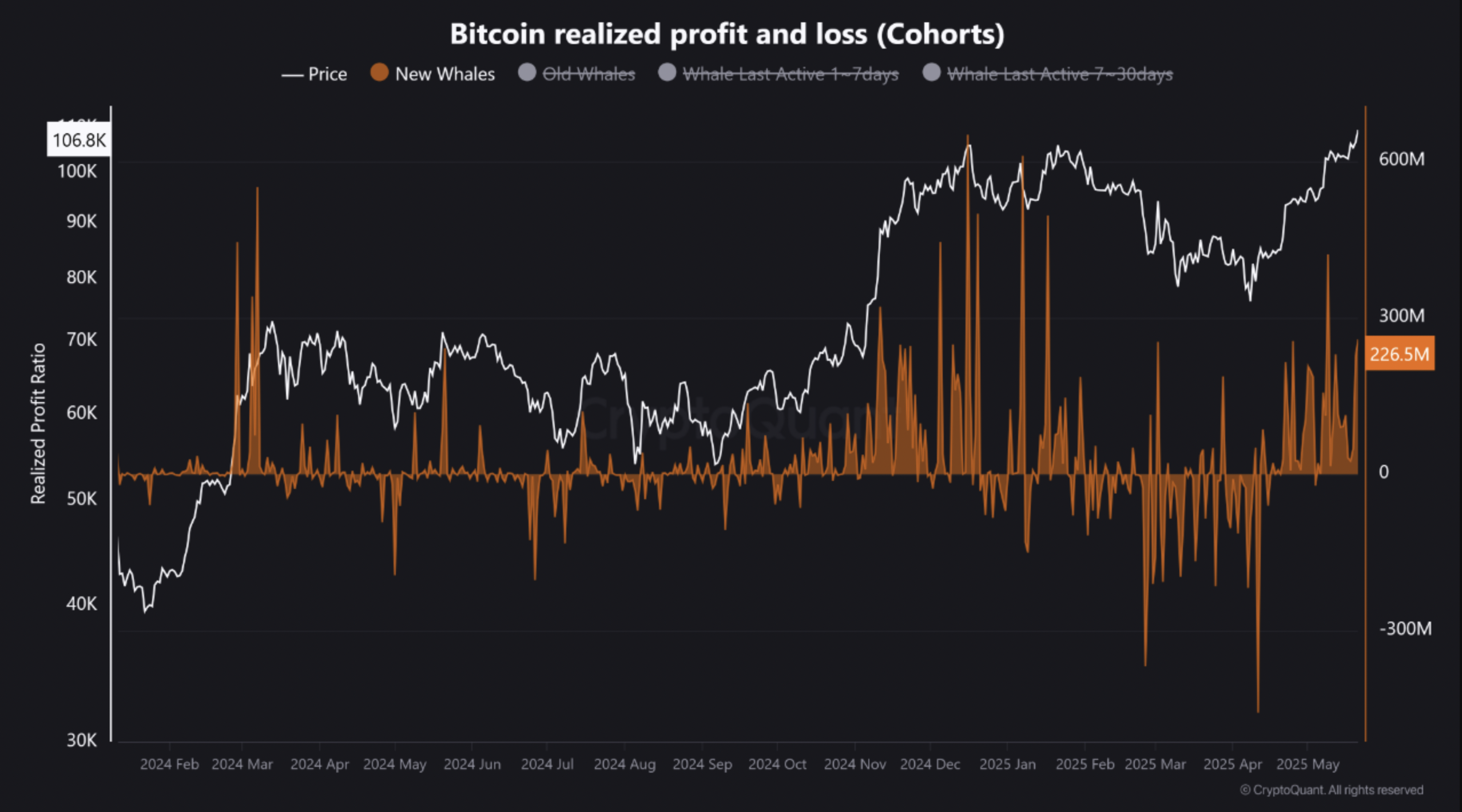

According to a recent CryptoQuant Quicktake post by contributor Crazzyblockk, new whales – wallets that have held substantial BTC amounts for less than 30 days – have been aggressively taking profits during the current price rally, contributing to increased selling pressure.

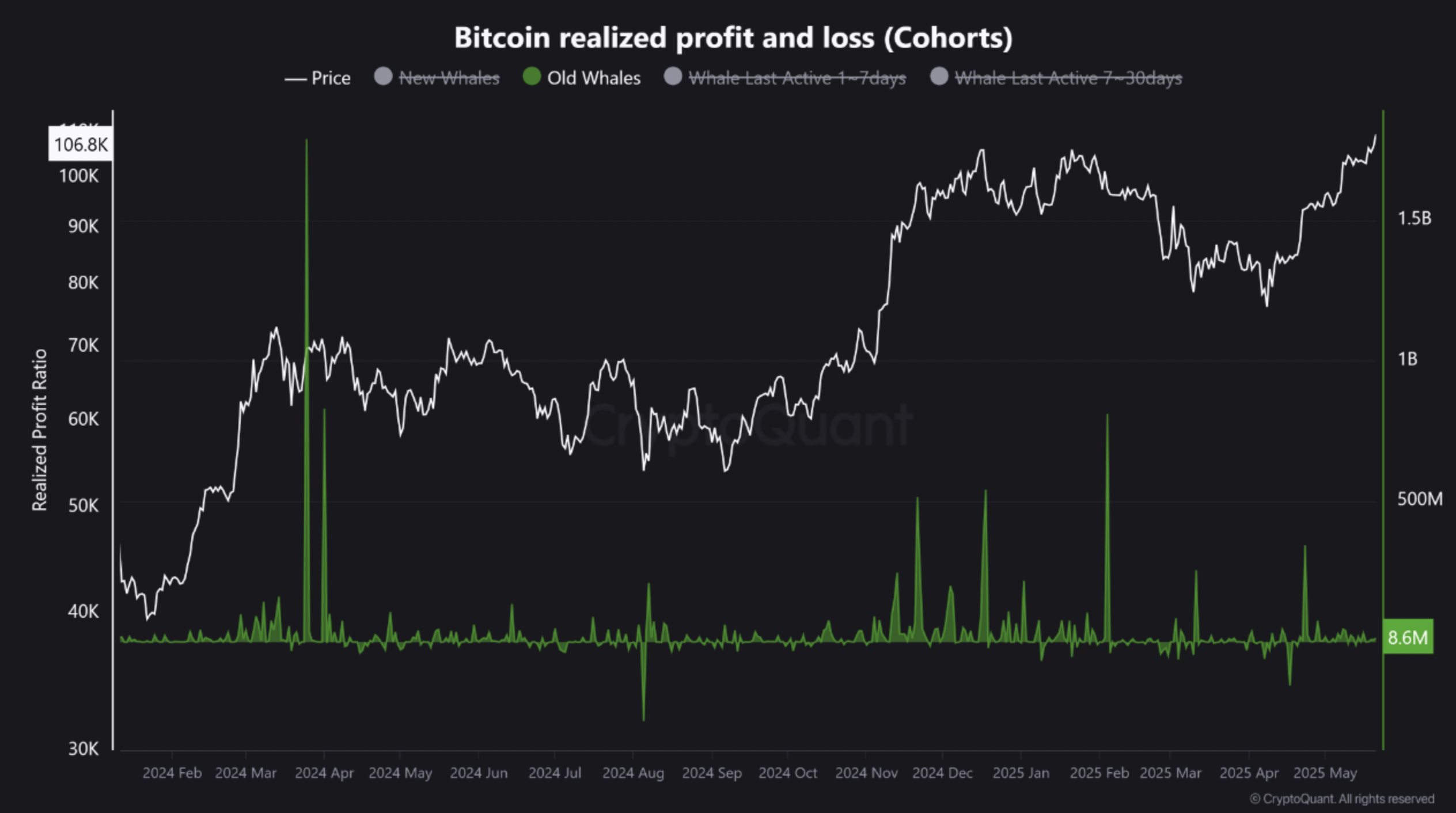

In contrast, old whales – wallets holding significant BTC for over six months – have shown minimal selling activity. This indicates long-term confidence in Bitcoin and expectations of continued price appreciation.

Meanwhile, whales active between 7 to 30 days ago have engaged in moderate profit-taking, suggesting cautious participation in the ongoing rally. While the restrained activity from old whales is a positive signal, some indicators point to caution regarding the rally’s sustainability.

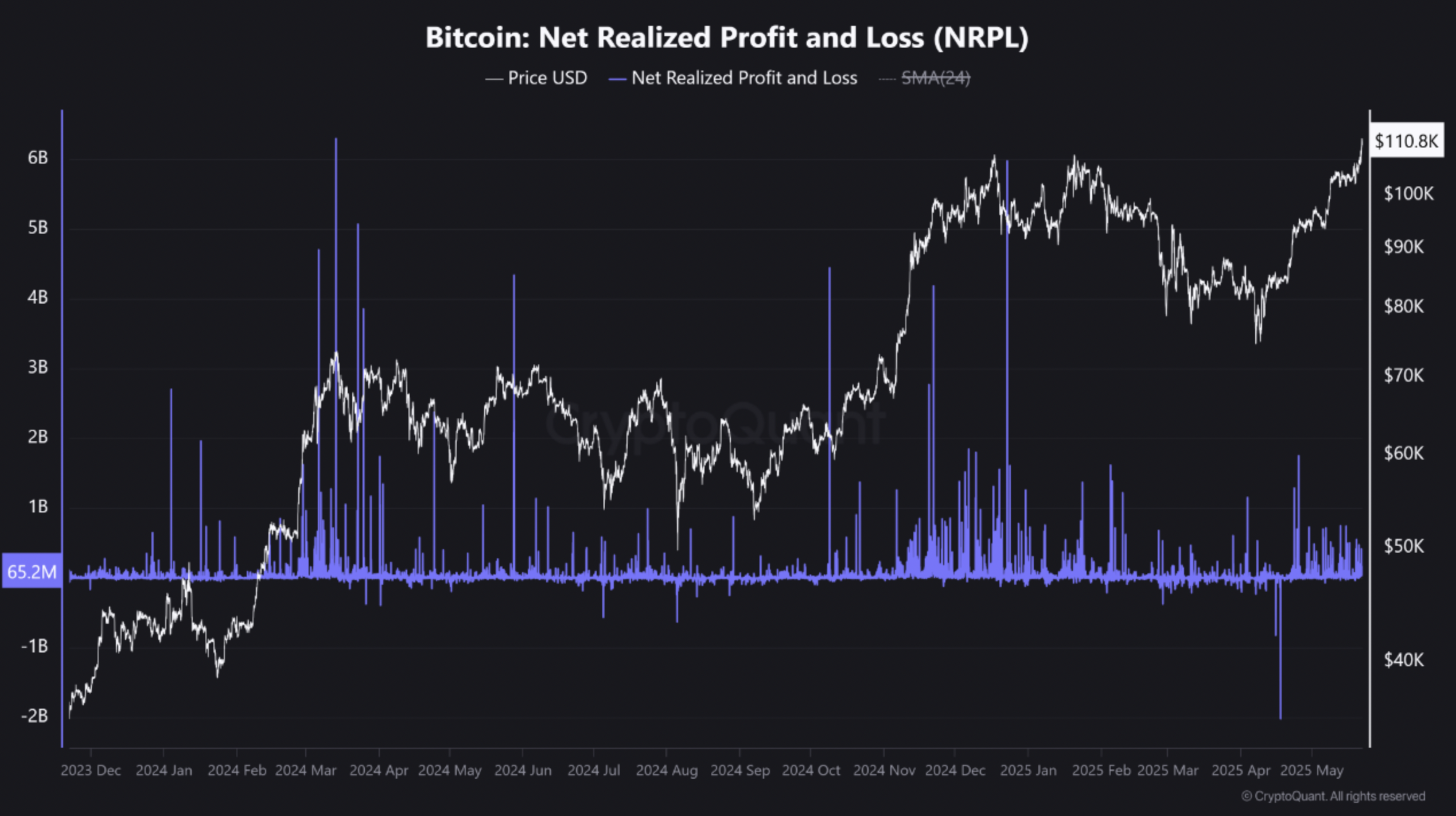

For example, the Net Realized Profit/Loss (NRPL) during the current price surge is significantly lower than levels observed during previous 2024-2025 market tops. This indicates weaker overall profit-taking momentum among investors.

For the uninitiated, NRPL measures the net profit or loss investors are locking in when they sell their Bitcoin, based on the price difference between acquisition and sale. A high NRPL indicates strong profit-taking behavior, while a low or negative NRPL suggests reduced enthusiasm or capitulation.

Is The Market Headed Further Up?

Although a low NRPL may imply that the market is not yet euphoric – a potentially healthy sign – it also raises concerns about the strength and sustainability of the ongoing rally. These dynamics could influence BTC’s price trajectory across different timeframes.

In the short-term, continued profit-taking by new whales may trigger a price correction to neutralize overheated market conditions. A drop in price could send BTC back to the $100,000-$105,000 support zone.

In contrast, in the mid-term, the ongoing inactivity of old whales coupled with low NRPL levels could support a bullish continuation after a consolidation phase. Investors may view pullbacks as opportunities to accumulate more BTC.

To conclude, while a short-term price correction remains possible, the mid-term outlook for Bitcoin is largely optimistic – assuming old whales maintain their positions and NRPL remains low.

This aligns with recent on-chain analyses showing that many new BTC investors are sitting on solid unrealized gains and are not showing signs of panic selling, despite Bitcoin trading close to ATHs. At press time, BTC trades at $111,500, up 4.2% in the past 24 hours.

답글 남기기