TL;DR

- Bitcoin (BTC) is trading below $110,000, but several elements suggest the asset may experience a substantial resurgence in the following weeks.

- Despite the positive signals, September has historically been a weak month for the asset.

Massive Gains This Month?

The primary cryptocurrency exploded to a new all-time high in mid-August, surpassing $124,000. Since then, though, it has struggled to maintain its momentum and now trades $15,000 lower. However, investors and crypto enthusiasts have not lost hope that the bull run is over, with all eyes now fixed on September.

One important event that could act as a major catalyst this month is the potential lowering of the interest rates in the United States. Less than two weeks ago, Jerome Powell, Chairman of the Federal Reserve, hinted at his speech in Jackson Hole that the benchmark might indeed be decreased before the end of the year.

The move (if implemented) will make money-borrowing cheaper and is likely to increase the interest in risk-on assets (such as BTC). Currently, the rates are in the range of 4.25% – 4.5% and the last time they were lowered was in December 2024.

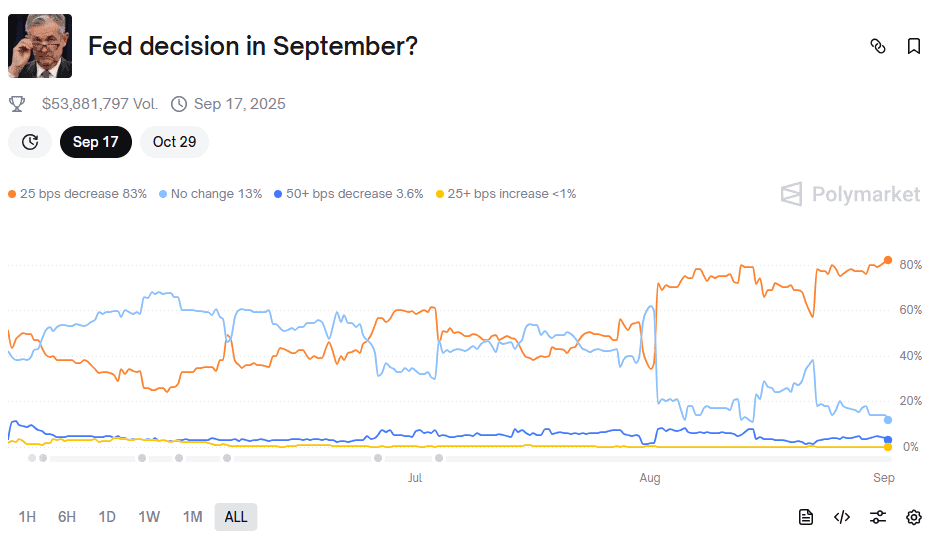

The Fed’s next FOMC meeting is scheduled for September, and according to Polymarket, there is an 83% probability that the percentage will be decreased by 0.25%. The odds of a more drastic drop by half a percent are a mere 3.6%, while “no change” is estimated at 13%.

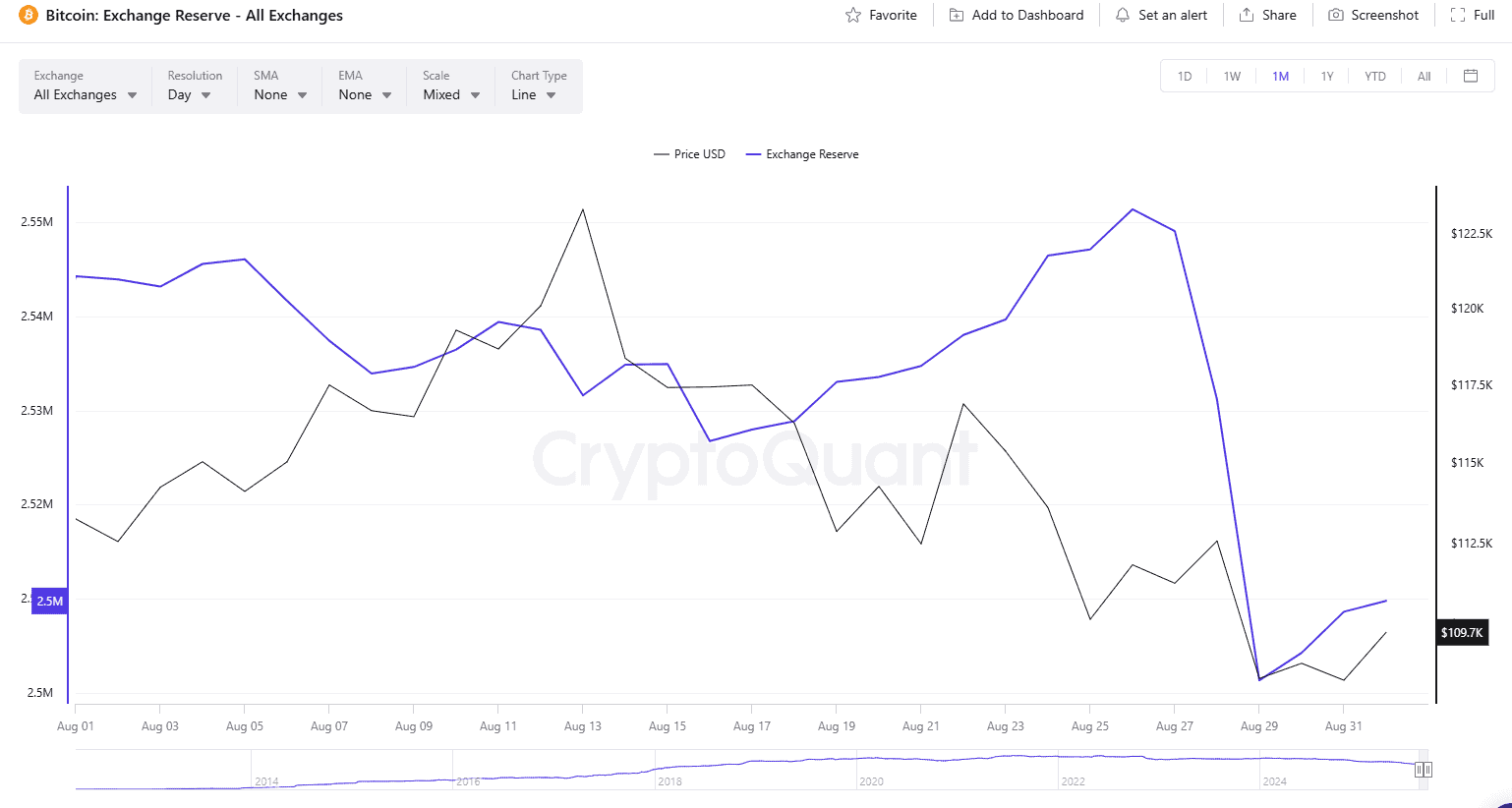

We move on to the amount of BTC stored on crypto exchanges, which, a few days ago, plummeted to a new seven-year low. The exodus from centralized platforms indicates that more and more investors are shifting toward self-custody methods, which reduces immediate selling pressure and could be interpreted as a bullish indicator.

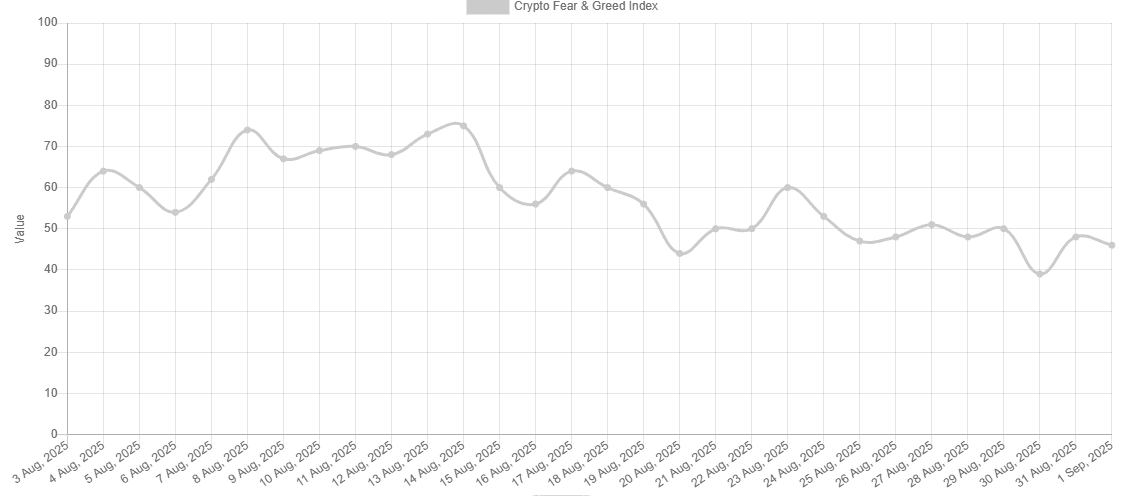

Last but not least, we will examine the popular Fear and Greed Index, which analyzes the current sentiment of the Bitcoin market. It ranges from 0 to 100 and shows the current state of the overall market sentiment from Extreme Fear to Extreme Greed. Due to the asset’s price retreat in the past few days, the index entered “Fear” territory and currently has a ratio of 46.

This may sound disturbing for bulls, but it sometimes indicates that the panic selling might already be behind us and could be seen as a buying opportunity. In cases like this, it is always helpful to cite Warren Buffett’s famous investment maxim: “Be fearful when others are greedy, and greedy when others are fearful.”

History Is on the Bearish Side

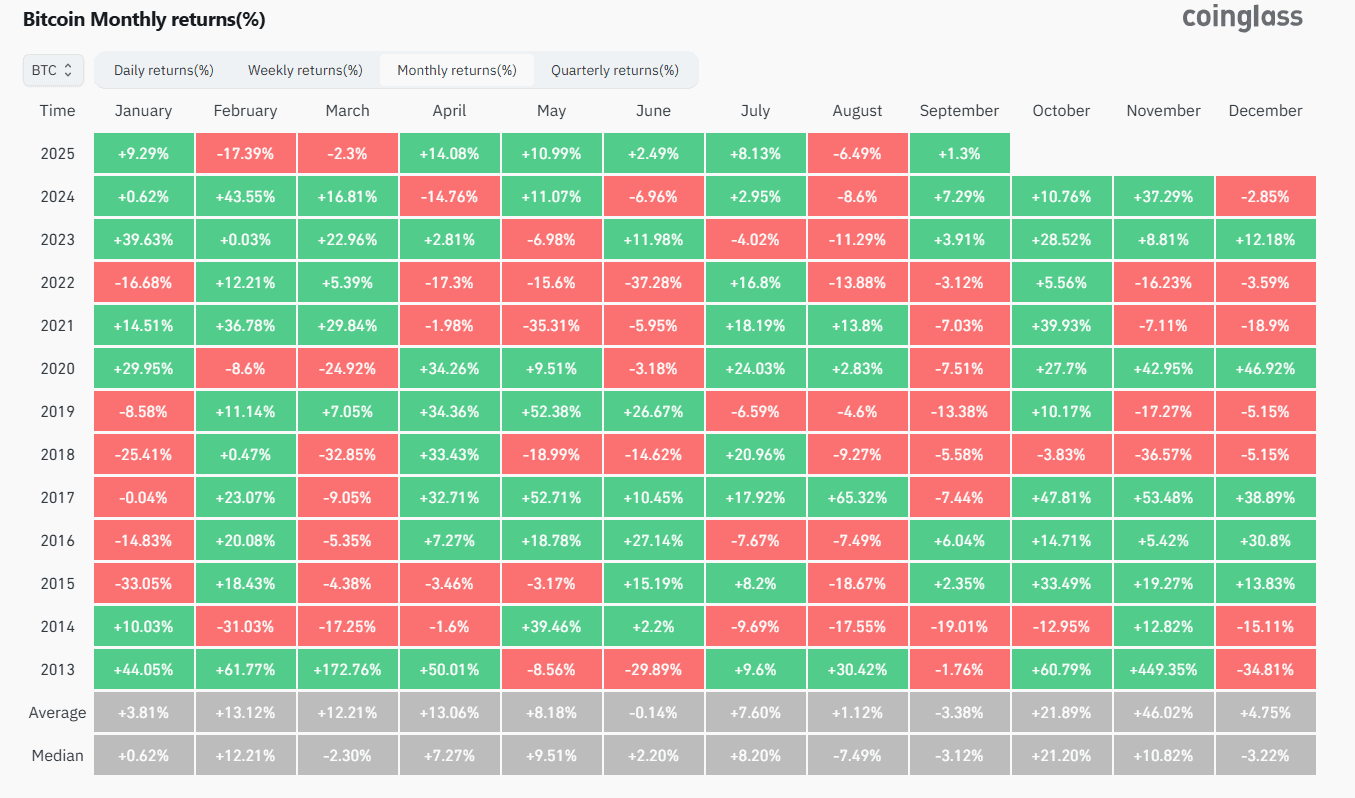

Despite the aforementioned factors that suggest BTC could rally in the next 30 days, investors should keep in mind the asset’s historical performance in September. In the past 12 years, the price managed to close in the green only four times.

Moreover, September has always been red for BTC following a halving year. Recall that the last halving happened in the spring of 2024, and it will be interesting to see whether history will repeat itself.

게시물 3 Big Reasons September Could Spark a Bitcoin (BTC) Rally 에 처음 등장 크립토포테이토.

답글 남기기