In the fourth quarter of 2024, Polygon (formerly MATIC) experienced a significant mixed performance in key metrics, primarily driven by the testnet launch of its interoperability protocol, Agglayer.

This new initiative aims to facilitate cross-chain token transfers and message-passing, enhancing the functionality and integration of various blockchain networks.

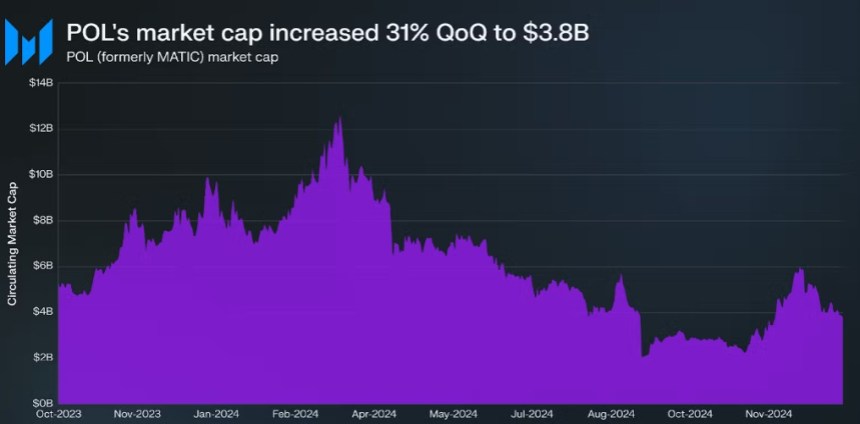

Polygon Market Cap Rebounds To $3.8 Billion

According to market intelligence firm Messari, by leveraging zero-knowledge (ZK) proofs, Agglayer promises secure communication and asset transfers, positioning itself as an innovative development akin to the introduction of TCP/IP in the early days of the internet.

Agglayer is designed to unify disparate blockchain chains by aggregating proofs, verifying chain states, and settling transactions on Ethereum (ETH). Among its critical features are a unified bridge for seamless asset connectivity and a pessimistic proof mechanism that prioritizes safety.

These advancements enable low-latency coordination and safe interoperability, allowing developers to concentrate on project design without the burdens of liquidity concerns.

Despite these promising developments, POL’s journey in 2024 has been turbulent. After achieving an all-time high market capitalization of $12.9 billion in Q1, the subsequent quarters saw a sharp decline, with the market cap plummeting to $2.9 billion by the end of Q3, marking a 47.2% quarter-over-quarter (QoQ) drop.

This downturn was partly due to the ongoing transition from MATIC to POL, which temporarily split market capitalization between the two tokens.

However, as market conditions began to stabilize in Q4, the migration of MATIC tokens—1.38 billion in total—into POL resulted in a 31% QoQ increase in POL’s market capitalization, which reached $3.8 billion by the end of the quarter.

Notably, 88.1% of the total supply had transitioned to POL, solidifying its position as the largest Ethereum Layer-2 token by market cap.

DeFi And NFT Markets Struggle

The enactment of EIP-4844 on the Polygon PoS mainnet in Q1 2024 introduced blobs, leading to a significant alteration in the cost structure for users. This update resulted in lower transaction fees, which dropped to just $0.01 during Q4.

However, despite the reduced costs, total transactions on the Polygon network fell by 2% QoQ, and active addresses saw a sharp decline of 39.4%, averaging 523,000 daily users.

The decrease in activity can be largely attributed to a downturn in the gaming sector, which had previously been a significant driver of user engagement. Average daily gaming active addresses plummeted to 54,000, marking a 66.7% QoQ decline.

Polygon’s DeFi landscape also faced challenges, with total value locked (TVL) ending Q4 at $871.5 million—down 4.9% QoQ and 2.6% YoY. This decline saw Polygon slip from the tenth largest network by TVL to the twelfth.

Moreover, NFT activity on the platform suffered, with average daily trading volume falling to $822,500, down 38.4% QoQ. Average daily NFT sales dropped to 21,000, a staggering 41.5% decrease.

The gaming sector, previously the fastest-growing area within Polygon, continued to struggle in Q3 and Q4, largely due to a slowdown in popular titles.

POL’s price has also faced notable challenges, with the token recording a significant 67% drop year-to-date as it currently trades at $0.30.

Featured image from DALL-E, chart from TradingView.com

コメントを残す