In his latest YouTube briefing to 292,000 subscribers, the analyst known as “More Crypto Online” (MCO) argued that Dogecoin’s recovery from early-May support keeps the memecoin’s larger Elliott-wave roadmap intact and, crucially, leaves open the long-discussed advance toward the $0.60 region.

Dogecoin’s Path To $0.60

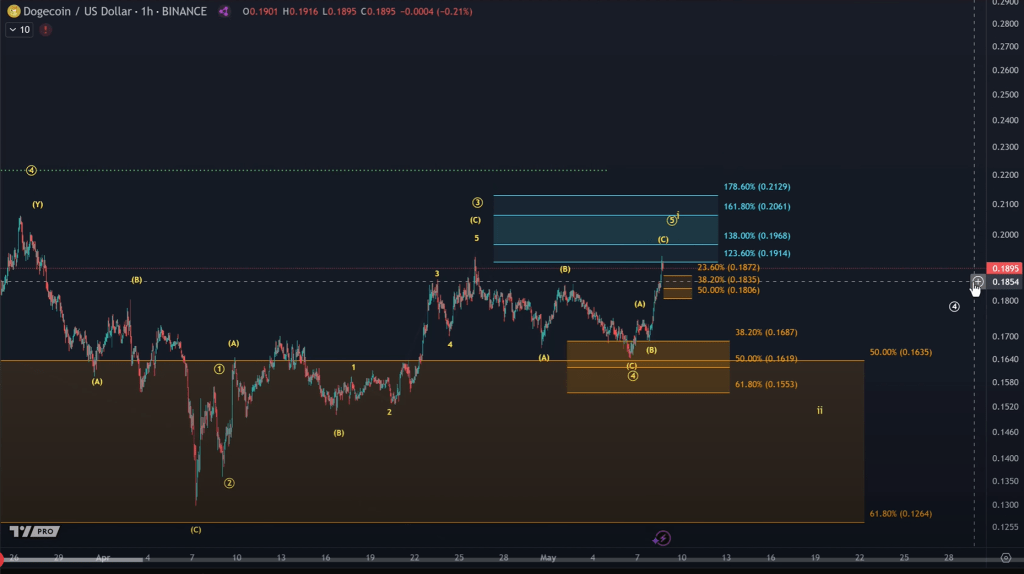

Speaking less than forty-eight hours after Dogecoin’s local low on 6 May at roughly $0.163, MCO underlined that price action has so far respected the fourth-wave Fibonacci retracement he mapped out in previous sessions. “The price held this support area between 15.5 cents and 16.8 cents as standard Fibonacci support in a wave four,” he noted, adding that the bounce has already satisfied the “bare minimum” requirement for a fifth-wave launch.

The analyst’s near-term pivot (1-hour chart) remains the $0.18 line—exactly the 50 percent retracement of the late-April impulse. “As long as we’re holding above $0.18, there’s absolutely no sign of a top,” MCO said, stressing that a decisive break below that threshold would force a reassessment of the intraday pattern and shift focus back to the 6 May swing low. He described $0.18 as the level that “allows for continuation, direct upside continuation, in an upside impulse.”

So far, Dogecoin’s latest push has only retested the 30 April high near $0.193, leaving the fifth wave “not healthy enough to really be considered a fifth wave that’s already completed.” The analyst therefore expects at least “one or two Fibonacci levels above where the third wave topped,” singling out the 123.6 percent, 138.2 percent and 161.8 percent extensions as conventional zones that would validate a properly extended fifth wave. The ideal target area thus begins fractionally above $0.193 and could stretch into the low-20-cent range if momentum remains intact.

MCO also mapped out the contingency in which the market loses the $0.18 floor. Provided the resulting retracement stays corrective and, critically, holds above the 6 May low at $0.163, he would view the setback as the “B-wave pullback” within a broader “wider ABC structure” that ultimately propels Dogecoin to fresh cycle highs. “That would allow for a wider ABC structure… and the B-wave pullback could just be corrective but must hold above this 6 May low,” he explained.

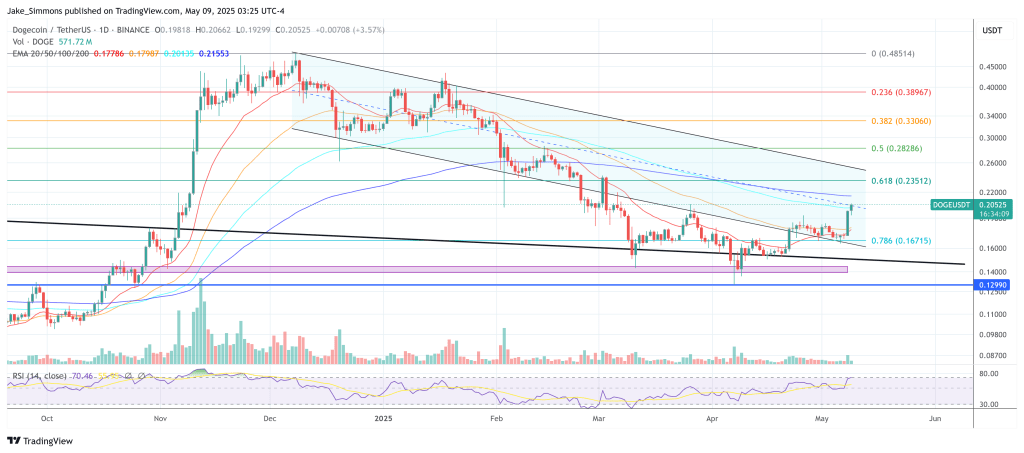

While the current segment concentrated on the micro-structure—whether the fifth wave finishes in a single thrust or morphs into a more complex ABC variant—the analyst reiterated that none of the outlined scenarios negate the larger bullish thesis so long as the $0.155 to $0.168 macro support band survives. That framework still culminates in a wave count that projects Dogecoin toward the psychologically important $0.60-cent region once the full higher-degree impulse cycle unfolds.

For now, the analyst’s dashboard remains straightforward: above $0.18, the burden of proof lies with bears; below it, the market will probe whether the corrective downswing is merely the prelude to the next—and potentially decisive—rally leg. As MCO concluded, “A direct move up remains the expectation […] but a break below will then, you know, force that discussion.”

At press time, DOGE traded at $0.205.

Featured image created with DALL.E, chart from TradingView.com

コメントを残す