It was just over two weeks ago when the predominant sentiment in the cryptocurrency market was whether the bull run had ended prematurely, as BTC’s price had tumbled to a five-month low of under $75,000. Now, the asset is pushing above $95,000.

A big portion of those gains came in the past week. As we explained in the Market Update from last Friday, the previous week went rather calmly, with BTC’s price trading sideways around $85,000. The weekend was similar, but the bulls stepped up on the gas pedal on Monday and didn’t look back.

At the time, bitcoin jumped by over three grand and broke out of its tight range where $86,000 played the role of an upper boundary. Just a day later, the cryptocurrency shot up past $90,000 for the first time since early March, and the gains kept on coming.

Perhaps driven by some レポート claiming the trade war between the US and China had calmed, at least for the time being, bitcoin flew past $95,000 earlier today to mark a two-month high. Naturally, the sentiment has changed once again, and the crowd is now asking whether $100,000 will fall next and when we will see a new all-time high.

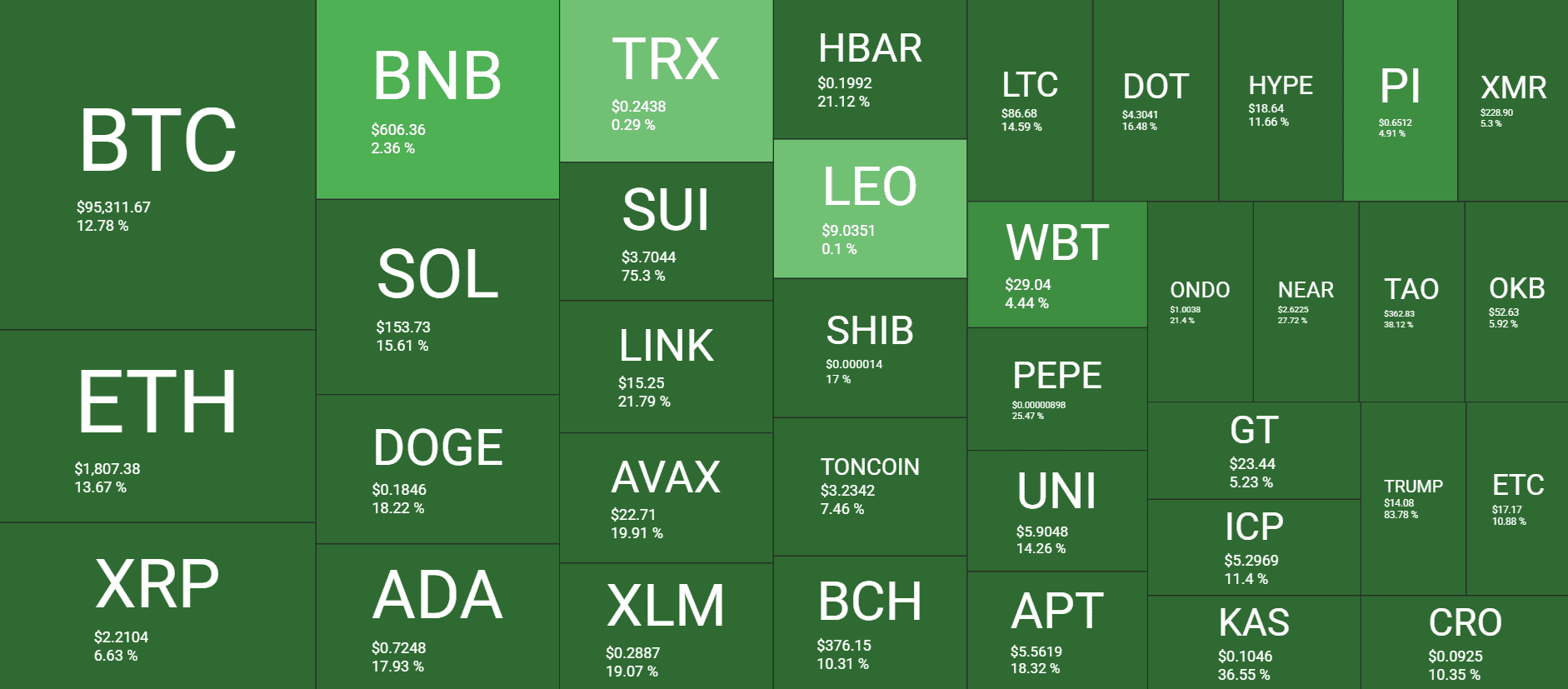

Looking at the weekly chart, BTC’s performance is quite impressive. The asset has gained more than 12%. However, many altcoins have posted even more notable price gains, such as SOL, DOGE, ADA, LINK, AVAX, and, of course, SUI, which has skyrocketed by 75% to trade at $3.7 now.

Market Data

Market Cap: $3.09T | 24H Vol: $115B | BTC Dominance: 61.3%

BTC: $95,300 (+12.8%) | ETH: $1,807 (+13.7%) | XRP: $2.21 (+6.6%)

This Week’s Crypto Headlines You Can’t Miss

ARK Invest Explains How Bitcoin (BTC) Could Shoot Up to $1.5 Million by 2030. Cathie Wood’s Ark Invest continues to be highly bullish on bitcoin’s price potential by upping its long-term prediction to somewhere between $1.5 million and $2.4 million per BTC. You can check Ark’s reasoning これ.

Bitcoin (BTC) Shows Resilience as It Strengthens and Decouples from Stock Markets. After the tariff-induced shock and price massacre, bitcoin’s aforementioned recovery brought a lot of hope back to the market. Moreover, the asset decoupled from traditional stocks, which showed strength and resilience, said CryptoQuant.

Bitcoin ETFs Record Largest Inflows Since Trump’s Inauguration in January. The economic uncertainty prompted by Trump’s trade war led to large outflows from the BTC ETFs within the past few months. However, the trend has changed now, with several consecutive days of net inflows. Moreover, April 22 became the highest single-day of net inflows since Trump’s inauguration.

Dinner with the President: Whales Go Crazy as TRUMP Coin Skyrockets. Among the most controversial news coming from US President Trump regarding the crypto community this week was the update on TRUMP’s meme coin website stating that the top 220 holders will have a chance to attend a special dinner with the POTUS. Naturally, this led to an immediate buying frenzy and price volatility.

Charles Hoskinson Says Ethereum May Not Survive the Next Decade. During another AMA session, Charles Hoskinson, who is not only the brain behind Cardano but also helped co-found Ethereum, 前記 the latter’s struggles will continue in the following decade and warned that today’s second-biggest blockchain network might not survive.

Arthur Hayes Predicts $200K Bitcoin Fueled by Treasury Buybacks. While Ark Invest expects a BTC price within the millions (in dollars) in the next 5-6 years, Arthur Hayes was more modest, making a case that the asset can skyrocket to $200,000 but on a shorter timeframe. He believes treasury buybacks will be a key reason behind such a potential rally.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Hype, and Solana – click here for the complete price analysis.

ポスト BTC Eyes $100K Amid Trade War Deescalation and Trump’s Special Dinner Announcement: Your Weekly Recap に初登場した。 クリプトポテト.

コメントを残す