The introduction of BitVM smart contracts has marked a significant milestone in the path for scalability and programmability of Bitcoin. Rooted in the original BitVM protocol, Bitlayer’s Finality Bridge introduces the first version of the protocol live on testnet, which is a good starting point for realizing the promises of the Bitcoin Renaissance or “Season 2”.

Unlike earlier BTC bridges that often required reliance on centralized entities or questionable trust assumptions, the Finality Bridge leverages a blend of BitVM smart contracts, fraud proofs, and zero-knowledge proofs. This combination not only enhances security but also significantly reduces the need for trust in third parties. We’re not at the trustless level that Lightning provides, but this is a million times better than current sidechains designs claiming to be Bitcoin Layers 2s (in addition to significantly increasing the design space for Bitcoin applications).

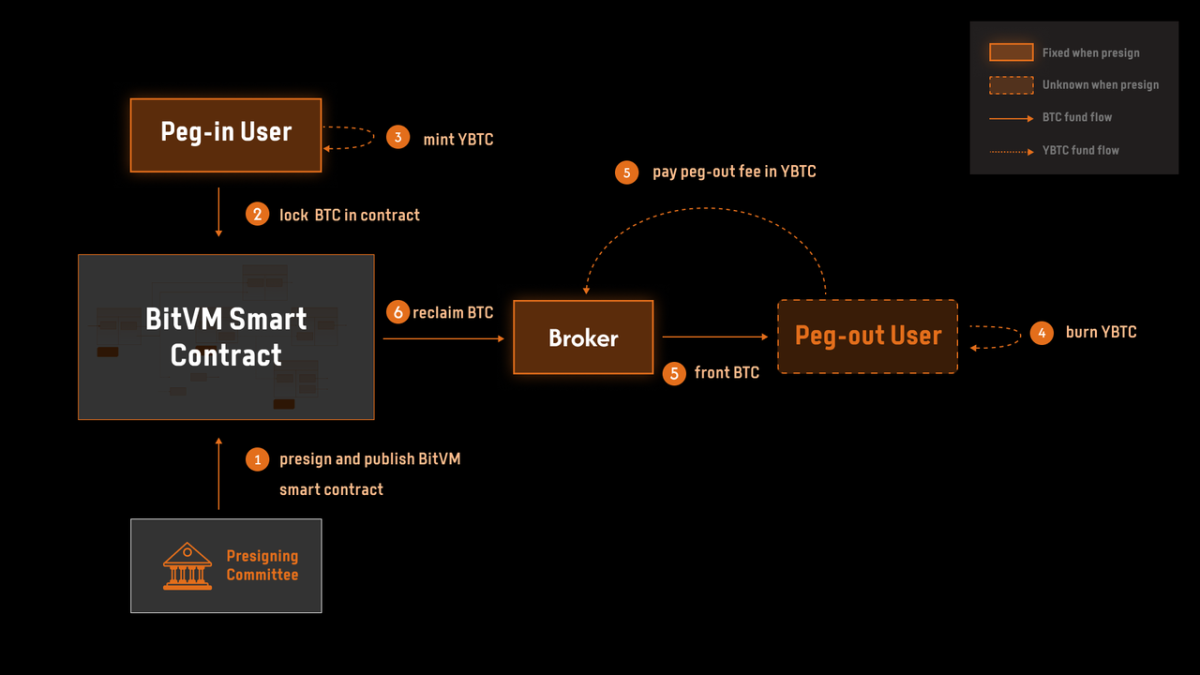

The system operates on a principle where funds are securely locked in addresses governed by a BitVM smart contract, functioning under the premise that at least one participant in the system will act honestly. This setup inherently reduces the trust requirements but has to introduce additional complexities that Bitlayer aims to manage with this version of the bridge.

The Mechanics of Trust

In practical terms, when Bitcoin is locked into the BitVM smart contract through the Finality Bridge, users are issued YBTC – a token that maintains a strict 1:1 peg with Bitcoin. This peg is not just a promise but is enforced by the underlying smart contract logic, ensuring that each YBTC represents a real, locked Bitcoin on the main chain (no fake “restacked” BTC metrics). This mechanism allows users to participate in DeFi activities like lending, borrowing, and yield farming within the Bitlayer ecosystem without compromising on the security and settlement assurances that Bitcoin provides.

While some in the community might find these activities objectionable, this type of architecture allows users to get some guarantees that they previously could not hope to get with traditional sidechain designs, with the added bonus that we do not need to “change” Bitcoin to make it happen (although covenants would make this bridge design completely “trust-minimized, which would effectively make it a “True” Bitcoin Layer 2). For more details about the different levels of risks associated with sidechains designs, take a look at Bitcoin Layers assessment of Bitlayer here.

However, until such advancements come to fruition, the Bitlayer Finality Bridge serves as the best realization of the BitVM 2 paradigm. It’s a testament to what’s possible after the dev “brain drain” from centralized chains back to Bitcoin. Despite all the challenges that BitVM chains will face, I remain exceptionally excited at the prospect of Bitcoin fulfilling its destiny as the Ultimate Settlement Chain for all economic activity.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Guillaume’s articles in particular may discuss topics or companies that are part of his firm’s investment portfolio (UTXO Management). The views expressed are solely his own and do not represent the opinions of his employer or its affiliates. He’s receiving no financial compensation for these Takes. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.

コメントを残す