As Bitcoin (BTC) continues its steady climb toward its all-time high (ATH) of $111,814 recorded in May 2025, the cryptocurrency is witnessing a notable shift in its holder composition. New on-chain data suggests that BTC “weak hands” are selling their holdings to larger investors.

Bitcoin Moving Upstream From Weak Hands To Big Money

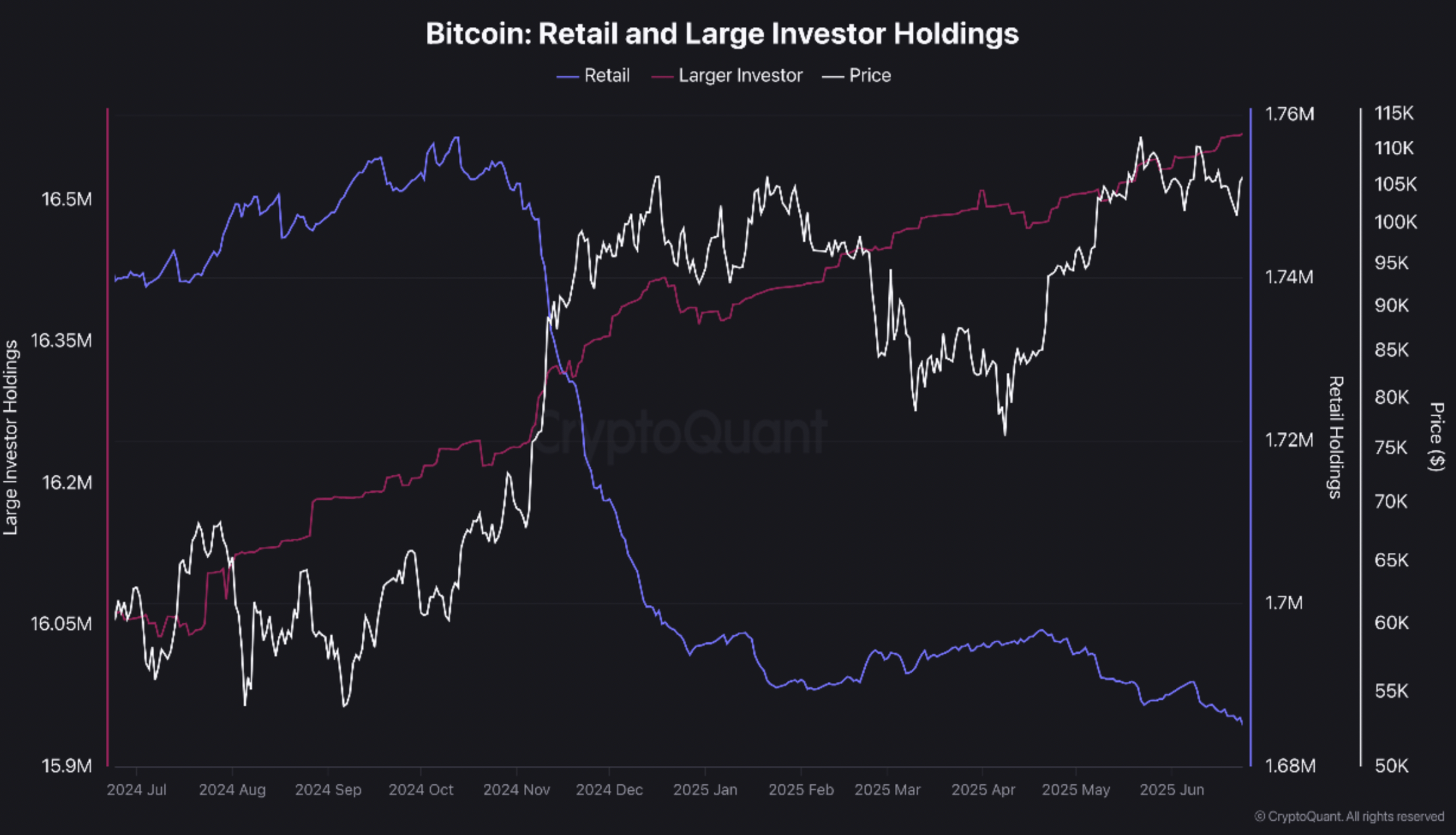

According to a recent Cryptoquant Quicktake post by contributor IT Tech, Bitcoin’s supply is moving upstream from retail investors to larger holders. This movement denotes a fundamental shift in the investor sentiment toward the largest digital asset.

Retail investors – those holding less than one BTC – have seen a significant reduction in their holdings, with total balances dropping by 54,500 BTC year-over-year (YoY), to 1.69 million BTC. On average, this cohort has experienced outflows of approximately 220 BTC per day.

In contrast, large holders – wallets with 1,000 BTC or more – have expanded their total BTC exposure by 507,700 BTC over the same period, bringing their combined holdings to 16.57 million BTC. This group is now seeing average inflows of around 1,460 BTC per day.

Institutional interest in Bitcoin also continues to rise at a historic pace. Notably, institutions are currently absorbing about seven times more BTC than retail investors are selling.

At the same time, the post-halving issuance of BTC is currently hovering around 450 BTC a day, raising the possibility of a true “supply squeeze” amid strong buying pressure. To recall, BTC underwent its latest halving in April 2024, when the mining reward for each block on the chain was slashed from 6.25 BTC to 3.125 BTC.

In their commentary, IT Tech noted that meaningful retail interest has yet to kick in during this cycle. Unlike previous market tops – where retail investors aggressively accumulated BTC – current data shows them exiting the market, suggesting that the bull run may still have more room to grow.

Another metric that points toward the market top being far from the current price level is the Bitcoin 30-day MA Binary CDD. In a recent analysis, CryptoQuant contributor Avocado_onchain noted that the BTC market is “far from overheating.”

BTC Short-Term Holder Floor Approaching $100,000

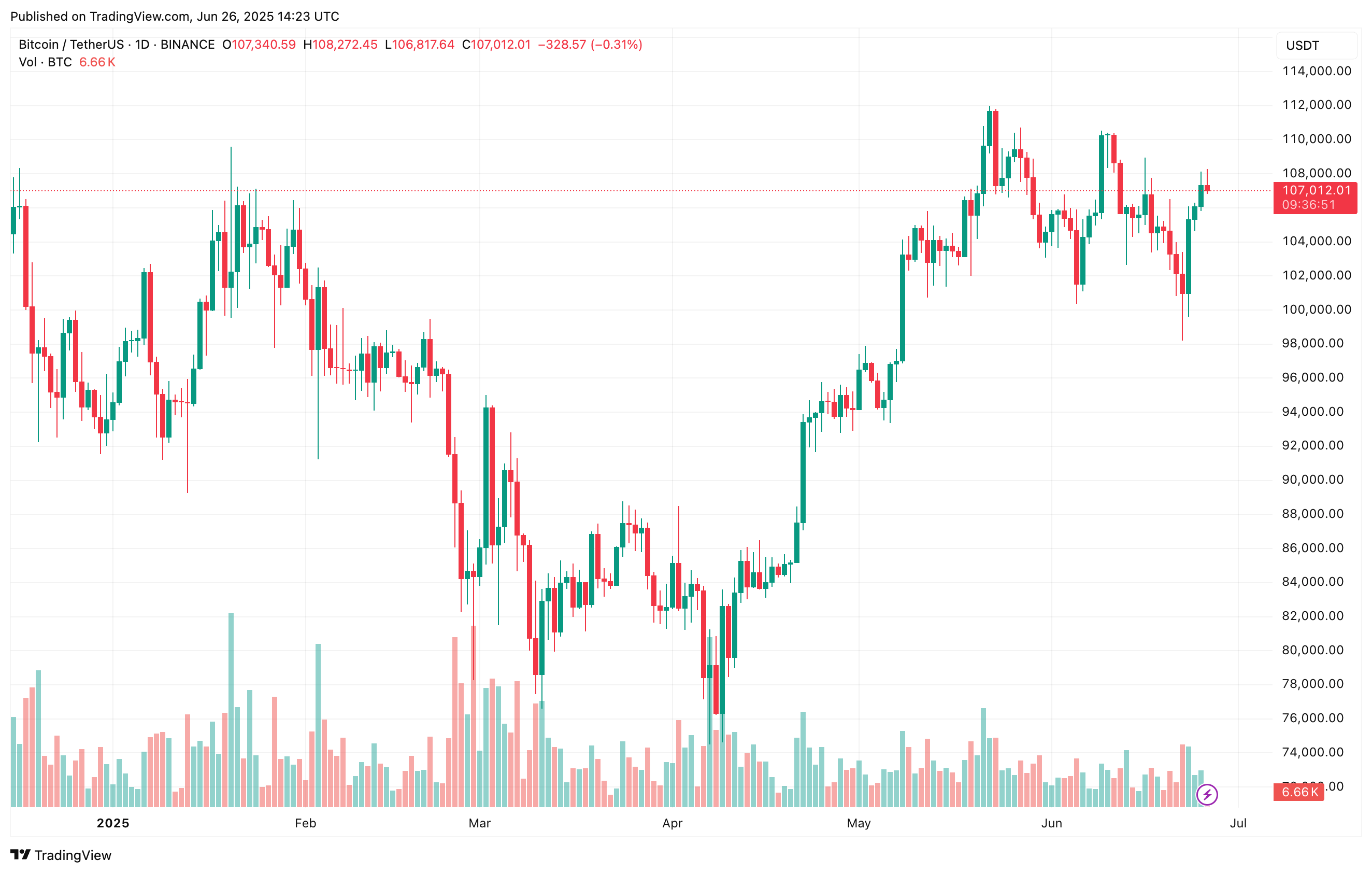

As BTC remains range-bound between $100,000 and $110,000, the short-term holder (STH) realized price – a key psychological support level – is steadily climbing. It currently sits near $98,000, reflecting rising investor conviction.

Further on-chain data also shows that both retail and institutional holders are reducing exchange deposits, signalling reluctance to sell at current levels. This behavior supports the idea that many are positioning for further upside. At press time, BTC trades at $107,012, down 0.5% in the past 24 hours.

コメントを残す