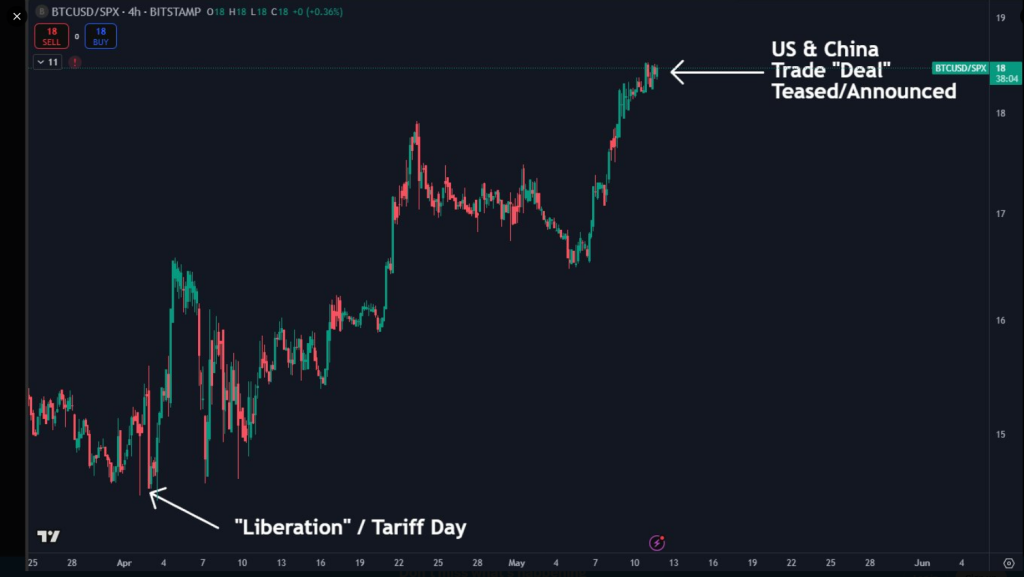

Bitcoin’s price has surged some 25% since April 2, even as the big stock indexes declined. The digital currency broke through $104,000 by May 12. Traditional markets such as the S&P 500 were in the red simultaneously. Based on market data, Bitcoin’s resilience has stood out in the face of sell-offs and tariff negotiations.

Bitcoin Outpaces Stocks

According to reports, the S&P 500 declined almost 1% during April, but Bitcoin rose. Other financial markets experienced losses during the same weeks. Bitcoin’s increase was made while traders considered concerns over escalating tariffs.

The world’s most sought-after crypto asset was seen by some as a means to avoid fees on foreign trade. However, there is no evidence that any country utilized crypto to avoid tariffs.

Settlements Via Bitcoin

Based on examination by crypto expert Daan Crypto Trades, there was speculation that countries could bring trade settlements to Bitcoin. The concept gained traction since BTC stood firm even when supply chains and markets were in trouble.

$BTC Has outperformed stocks since “Liberation” / Tariff Day on the 2nd of April.

It held up incredibly strong during a sharp sell off on stocks in April.

It then also proceeded to outperform as the markets bounced and tariffs were implemented.

Back then people were wondering… pic.twitter.com/gfvfH80TVP

— Daan Crypto Trades (@DaanCrypto) May 11, 2025

Nevertheless, experts note that big on-chain transactions are out there in the open. Regulators would catch any large cross-border payments made in crypto. There has not been a reported case of governments turning to Bitcoin in order to sidestep duties.

Testing Key Resistance Levels

According to chart analysis by Rose Premium Signals, ビットコイン is currently testing a crucial barrier at $105,000. If BTC breaks down there, it might retreat into the $100,000 zone. Some pattern observers claim an Inverse Head & Shoulders configuration could develop.

$BTC Market Update#ビットコイン is currently testing the Weekly Supply Zone around $105,000

The most likely scenario is a rejection from this level, leading to the formation of an Inverse Head & Shoulders pattern — a setup that could create space for a mini #altseason

… pic.twitter.com/aLSPi5qhuq

— Rose Premium Signals

(@VipRoseTr) May 11, 2025

That pattern requires two distinct shoulders and a lower trough in the middle. Currently, the swings have been unbalanced, muddying the image. A rejection might be followed by a brief period of altcoin accumulation before Bitcoin takes off again where it left off.

Long-Term Outlook Stable

As per market observers, most investors will be looking to purchase dips if Bitcoin breaks resistance. They add that higher prices will put the limelight on pullbacks. Dips provided entry points during previous rallies. But Bitcoin’s extensive runs persist for several months, not days.

Risks are still seen by traders: potential rate increases, regulations on crypto, and fresh tokens competing for attention. Meanwhile, increasing ETF flows and fortified wallets reassure others.

Based on accounts of US–China trade negotiations, any agreement would reduce some tension. But there are drivers of Bitcoin’s price that are independent of global tariffs. Monetary actions, large investors, and sentiment drive big moves.

If BTC continues to outrun stocks, it might solidify itself as an alternative in global markets. In the meantime, traders are waiting for the next direction at those important levels near $105,000.

Featured image from Unsplash, chart from TradingView

The most likely scenario is a rejection from this level, leading to the formation of an Inverse Head & Shoulders pattern — a setup that could create space for a mini

The most likely scenario is a rejection from this level, leading to the formation of an Inverse Head & Shoulders pattern — a setup that could create space for a mini  …

…  (@VipRoseTr)

(@VipRoseTr)

コメントを残す