The US Bitcoin ETFs are strongly reflecting the bullish sentiments that are ravaging the crypto market at the moment. Following an impressive performance in the third week of April marked by $3.06 billion in net inflows, these Bitcoin ETFs did well to retain investors’ interest by attracting almost $2 billion in deposits over the past week.

Notably, Bitcoin has recently seen a market rebound, with prices moving from $84,000 to $97,000 in the last two weeks. The rising inflows to Bitcoin demonstrate a strong market demand backing this resurgence, hinting at the potential of a sustained uptrend.

Bitcoin ETFs Drive Into May On Bullish Note

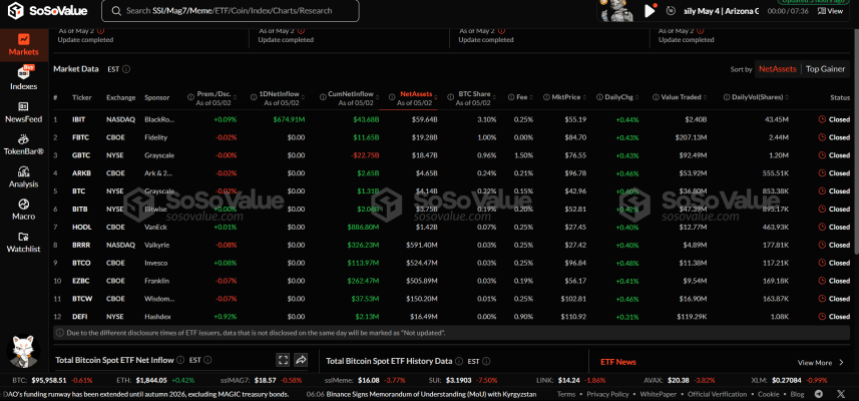

According to ETF tracking platform SoSoValue, the US Bitcoin Spot ETFs recorded $1.81 billion in net inflows as the market crossed into the month of May. This represents the third-largest weekly inflow in 2025 as institutional investors actively rotate their capital into the cryptocurrency and all related markets.

In a familiar tale, BlackRock’s IBIT attracted the largest investments with over $2.48 billion in net inflows. Interestingly, IBIT accounted for all deposits on Friday, May 2nd, valued at $674.91 million, demonstrating an unrivaled market dominance.

Other ETFs that experienced a net inflow include Grayscale’s BTC, VanEck’s HODL, and Invesco’s BTCO, with investments ranging from $10 million – $41 million. Meanwhile, Fidelity’s BTCO accounted for the largest weekly net outflow at $201.90 million in what proved a bearish week for the second-largest Bitcoin ETF.

Grayscale’s GBTC and Bitwise’s BITB also registered net withdrawals valued between $30 million – $60 million. While Franklin Templeton’s EZBC, Wisdom Tree’s BTCW, Hashdex’s DEFI, and Valkyrie’s BRRR have zero market flows. Following this bullish trading week, the US Bitcoin Spot ETFs boast of $40.24 billion in cumulative total net inflow. Meanwhile, their total net assets are now valued at $113.15 billion, representing 5.87% of Bitcoin’s market cap.

Ethereum ETFs Score $107 Million In Investments

Alongside the resurgence with their Bitcoin counterparts, Ethereum Spot ETFs are also experiencing a notable rebound, recording over $250 million in net inflows over the past two weeks. Specifically, these ETFs registered $106.75 million in inflows in the last trading week, with BlackRock’s ETHA accounting for the majority share.

Presently, these ETFs hold a cumulative total net inflow of $2.51 billion and total net assets of $6.40 billion, which represents 2.87% of the Ethereum market cap. At the time of writing, Ethereum continues to trade at $1,845 following a 0.49% decline in the past 24 hours. Meanwhile, Bitcoin remains valued at $95,514.

コメントを残す