Bitcoin’s price actions have calmed in the past several hours around the $118,000 mark, perhaps in anticipation of the FOMC meeting scheduled to take place later today.

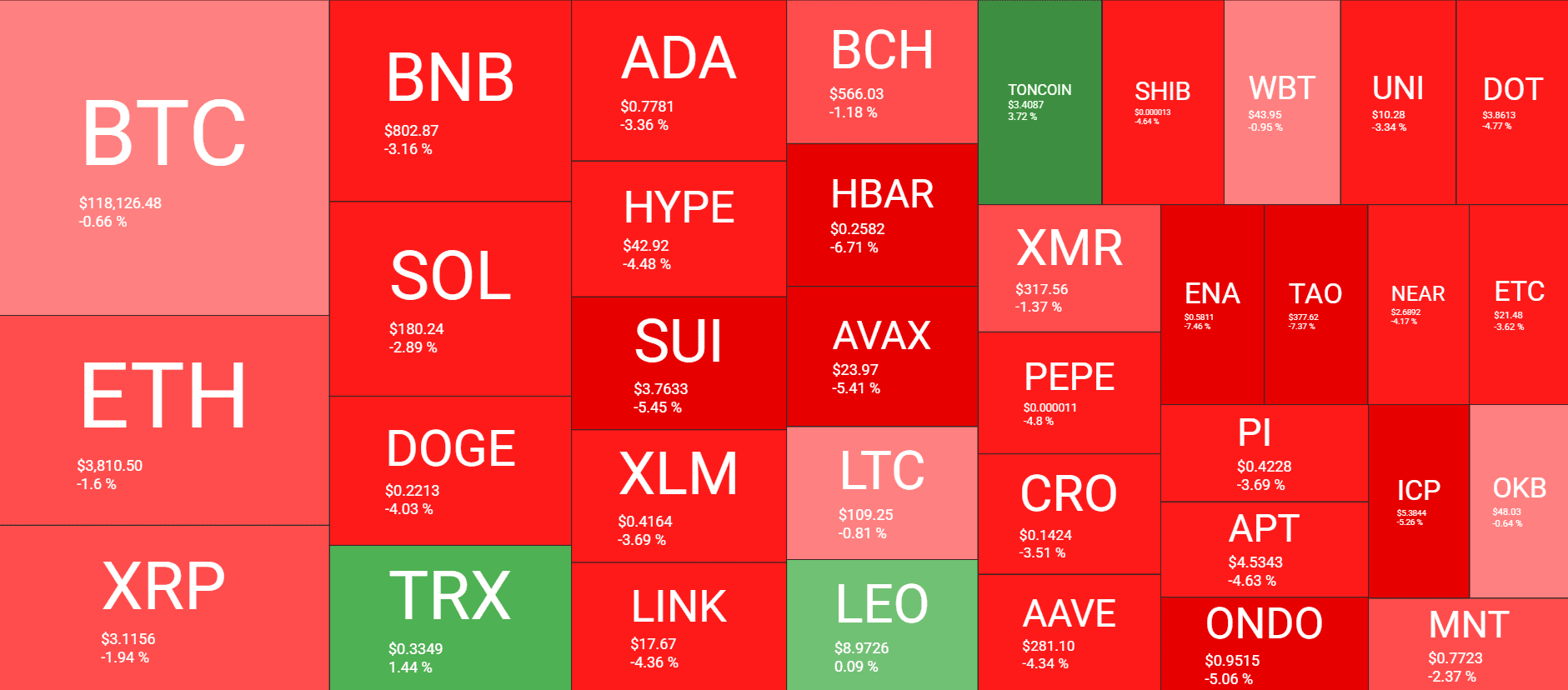

Most altcoins are in the red today, led by substantial losses from some larger caps like SUI, HBAR, AVAX, ENA, TAO, and ICP.

BTC Anticipates FOMC Meeting

The primary cryptocurrency nosedived at the end of the previous business week, dropping from over $119,500 to a 14-day low of $114,500 within hours as Galaxy Digital was selling off 80,000 BTC for a third party. The asset bounced during the weekend and returned above $117,000 as the sale was completed.

It started the new week on the right foot, surging to $120,000. However, as it has happened after each such breakout attempt for the last two weeks, the bears quickly reemerged and didn’t allow a more decisive surge toward BTC’s all-time high.

Just the opposite, as bitcoin started to lose value rapidly and dropped below $117,500 on a couple of occasions on Monday and Tuesday. It has managed to rebound so far and now trades around $118,000. More volatility is expected later today as the US Federal Reserve will announce whether it will change interest rates, although this is unlikely.

For now, BTC’s market cap remains close to $2.350 trillion, while its dominance over the alts has risen to 59.6% on CG.

Alts Back in Retreat Mode

Most altcoins have turned red on a daily scale. Ethereum was rejected at $3,900 and is close to breaking below $3,800 after a 1.6% daily drop. XRP has slipped toward $3.1 after a 2% decline. BNB, SOL, DOGE, ADA, HYPE, XLM, and LINK have marked even more substantial losses.

The situation with SUI, HBAR, and AVAX is even more painful as all of those are down by over 5% in the past day. ENA, TAO, and ICP are with similar losses.

BONK has dumped the most over the past 24 hours, losing 13% of value, followed by TIA (-9%) and SPX (-9%).

The total crypto market cap has declined by $60 billion overnight and is down to $3.940 trillion on CG.

ポスト Bitcoin Price Calms at $118K Ahead of FOMC Meeting, BONK Dumps Hard: Market Watch に初登場した。 クリプトポテト.

コメントを残す