Bitcoin remains in a state of balance between buyers and sellers, leading to uncertainty regarding its future price movements.

The market has exhibited minor fluctuations, requiring increased trading activity to determine its next directional move.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin has been experiencing insufficient trading activity in both spot and perpetual markets, resulting in a period of sideways price action with extremely low volatility. This stagnation, coupled with the RSI indicator hovering around the 50 mark, clearly indicates an equilibrium state between buyers and sellers, with uncertainty prevailing as the dominant market sentiment.

For BTC to establish a clear directional trend, higher trading volume and increased demand or supply are necessary. However, given multiple key support levels, the price will likely find solid footing around the $90K threshold, potentially leading to a notable surge toward the $108K mark.

The 4-Hour Chart

On the 4-hour timeframe, a strong support region emerged within the $92.5K-$94.3K fair value gap, which has repeatedly kept the price from declining further. This area appears filled with demand, effectively halting sellers’ downward attempts.

Additionally, this key level coincides with the prolonged ascending wedge’s lower boundary and the short-term bullish flag’s lower trendline, reinforcing its significance as a critical defense zone for buyers. As a result, BTC is expected to encounter increased buying activity at this level, initiating a potential surge toward the flag’s upper boundary at $98K, with the $108K threshold as the next target.

On-chain Analysis

By Shayan

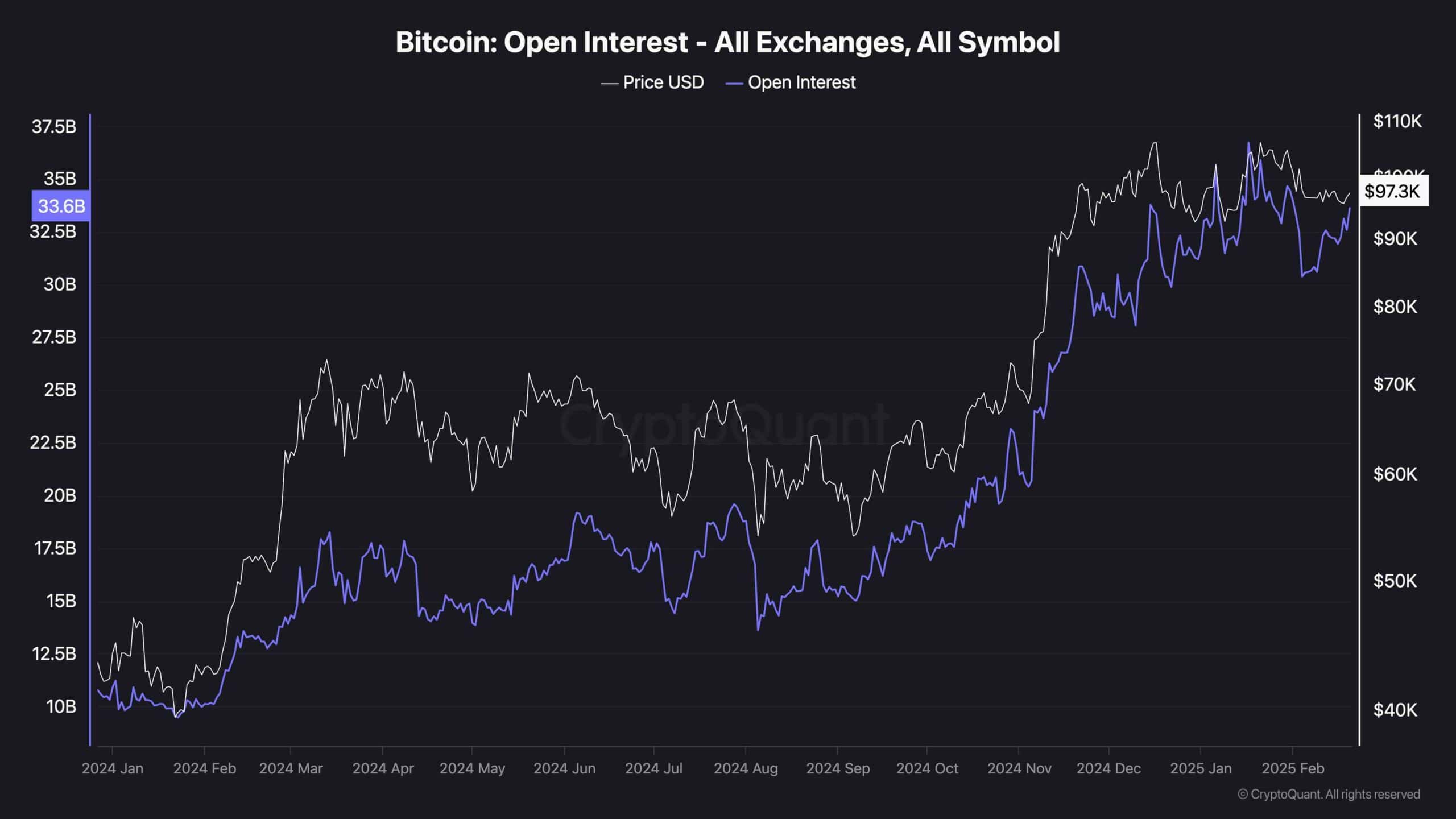

While Bitcoin’s price action lacks clear directional cues, deeper research into the underlying market dynamics is necessary. Analyzing futures market metrics can provide valuable insights into the current situation.

This chart illustrates BTC’s open interest metric, which measures the total number of open perpetual futures contracts on centralized exchanges. Despite Bitcoin’s recent price fluctuations and indecision, the open interest has been trending upward. This increase suggests that more activity is flowing into the perpetual markets.

If this trend persists, the market will likely experience a major breakout in the mid-term. However, the direction of this move remains uncertain, as additional data is required to make an accurate prediction.

ポスト Bitcoin Price Analysis: Is BTC in the Calm Before the Storm? に初登場した。 クリプトポテト.

コメントを残す