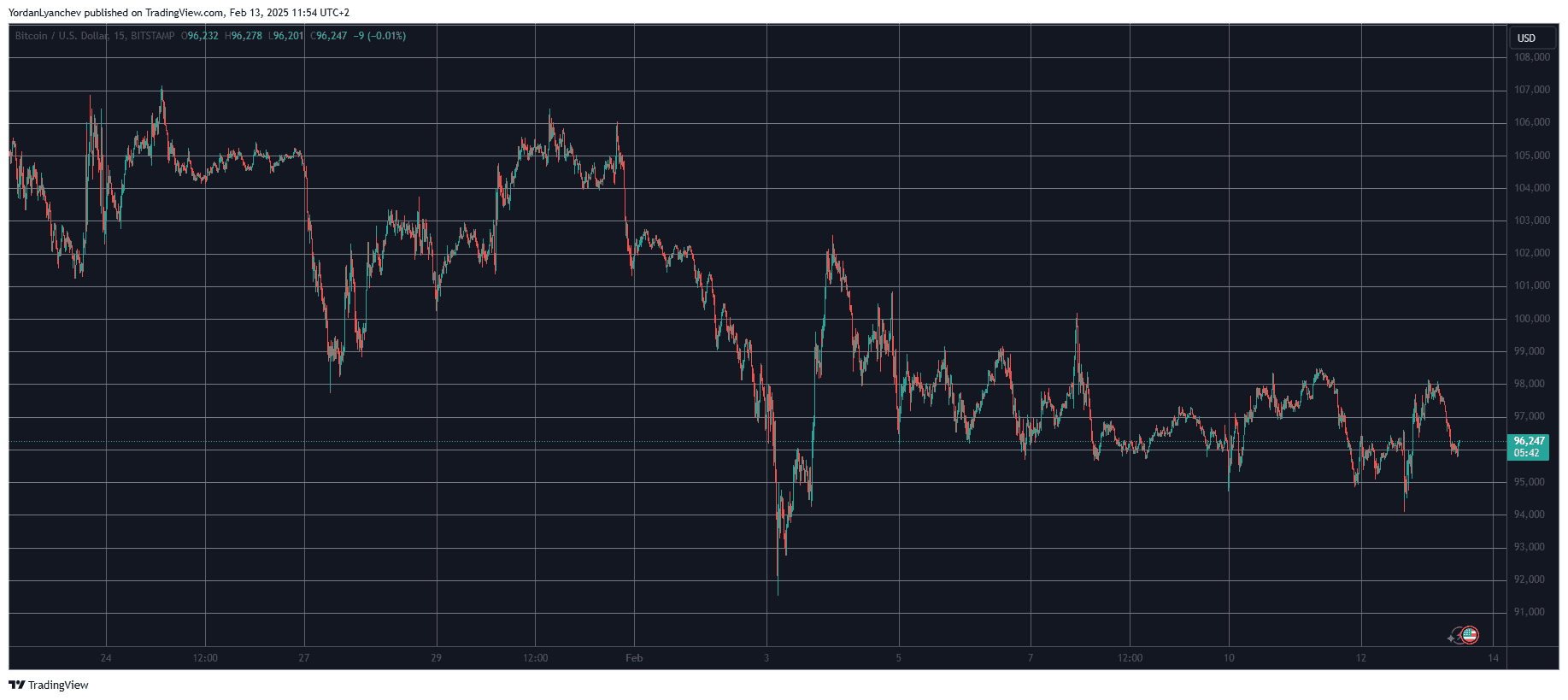

Bitcoin’s price dipped by a few grand yesterday after the worst-than-expected US CPI data but bounced off and even tapped $98,000 briefly before settling at around $96,000.

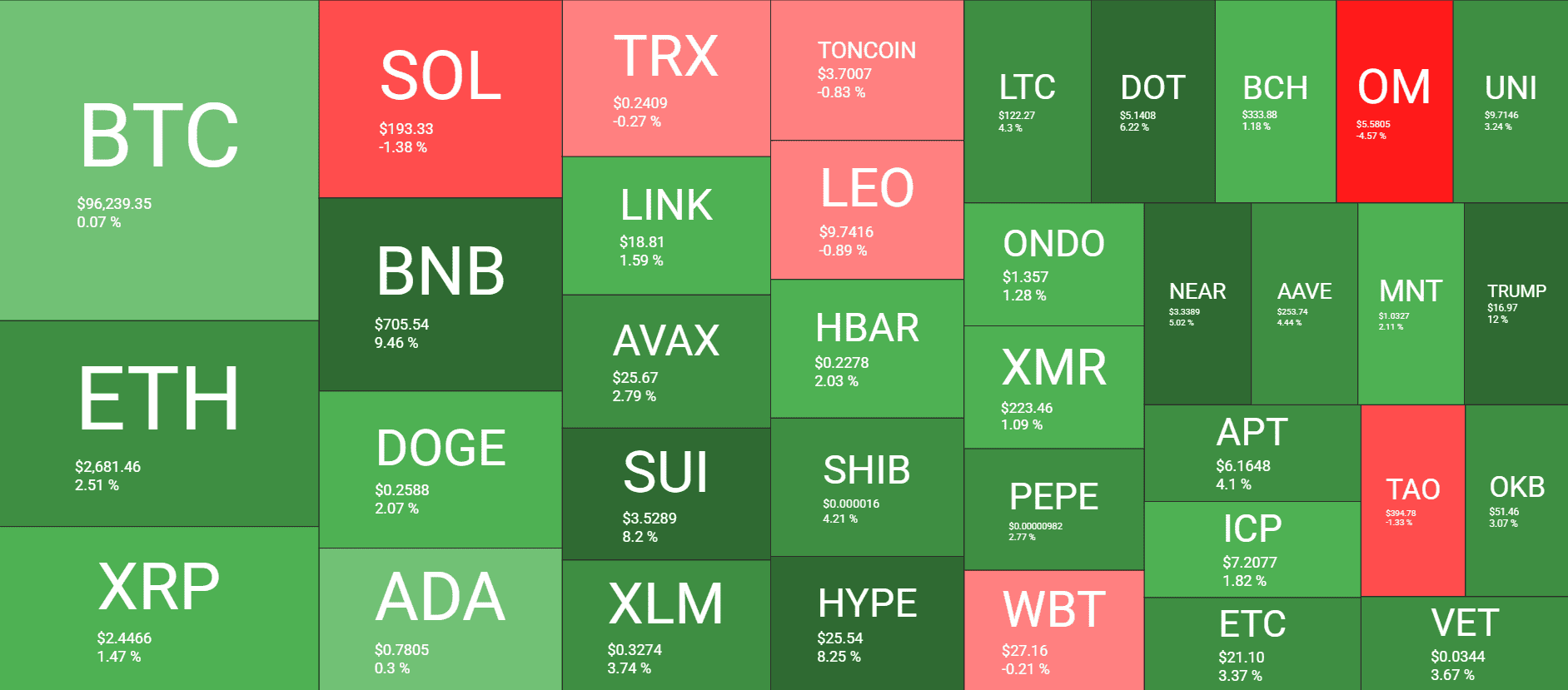

BNB, HYPE, and SUI have emerged as the biggest gainers from the larger-cap alts today, while ETH failed at $2,700 following positive news.

BTC Recovers

The primary cryptocurrency went through a full-on rollercoaster at the start of the previous week, with multiple $10,000 moves in both directions. It settled in the following days in a tighter range between $96,000 and $98,000, aside from a brief spike toward $100,000 on Friday.

The subsequent rejection, though, pushed it south to the lower bound of the range, where it spent most of the weekend as well. The business week began with a price pump toward $98,000 but was halted once again.

More volatility was expected yesterday following the release of the US CPI numbers. Once they went live and were higher than the general expectations, BTC slipped by two grand within minutes to $94,000.

However, the asset bounced off immediately and added four grand by the Thursday morning Asian trading session. It was stopped once again there and now sits just inches above $96,000.

Its market capitalization has remained at just over $1.9 trillion, while its dominance over the alts has taken a big hit and is down to 57.6%.

BNB Back Above $700

イーサリアム jumped high this morning after CBOE filed for a spot staked ETH ETF on behalf of 21Shares. However, it quickly lost most of the gains and is now below $2,700 once again. XRP, DOGE, ADA, LINK, AVAX, and XLM are also slightly in the green on a daily scale.

BNB has jumped the most, adding 9.5% of value and trading above $700 now. SUI and HYPE followed suit, with 8% gains, which have pushed them to $3.5 and $25, respectively.

Some meme coins have posted impressive increases over the past day as well. Nevertheless, the total crypto market cap has remained still at just over $3.3 trillion on CG.

ポスト Bitcoin Bounces Back From CPI Dip as BNB Breaks $700 (Market Watch) に初登場した。 クリプトポテト.

コメントを残す