On-chain data shows key investors on the Bitcoin network have collectively participated in some selling recently, a potential reason behind the asset’s decline.

Bitcoin Sharks & Whales Have Done Some Net Distribution

According to data from on-chain analytics firm Santiment, Bitcoin’s key investor tier is starting to show signs of slight profit-taking. The indicator of interest here is the “Supply Distribution,” which measures the total amount of the supply that investors belonging to a particular wallet segment are currently holding.

Addresses or holders are divided into these groups based on the number of tokens present in their balance. The 1 to 10 coins cohort, for instance, includes all investors owning between 1 and 10 BTC. In the context of the current discussion, a broad range of 10 to 10,000 coins is of focus. It converts to $1.1 million at the lower end and $1.1 billion at the upper end. Given this scale, the range would naturally cover some of the key Bitcoin investor cohorts like the sharks and whales.

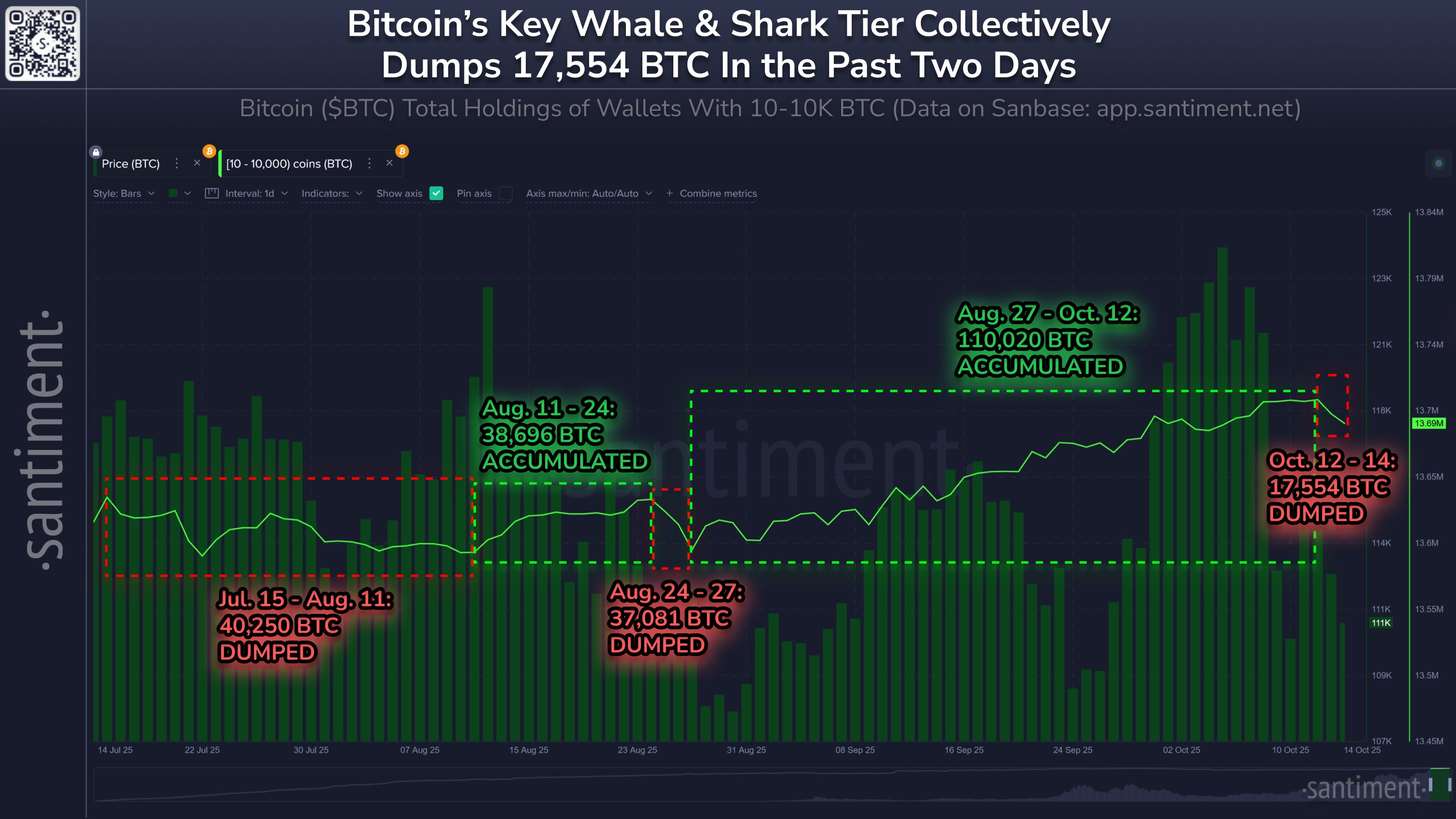

Below is the chart shared by Santiment that shows the trend in the Supply Distribution for the range over the last few months.

As displayed in the above graph, the Bitcoin supply held by the 10 to 10,000 coins group saw a drop of 17,554 BTC (about $1.9 billion) between October 12th and 14th. Before this decline, the metric had been in an uptrend since late August. The cryptocurrency’s recovery attempt has fizzled out since this selloff occurred, so it would appear possible that the profit-taking from the sharks and whales could, in part, be behind the bearish action.

On a more long-term scale, though, this latest distribution spree from the key investors isn’t too significant, as their wallets have still grown since the start of 2025 by 318,610 BTC, worth a whopping $35.5 billion.

A similar light profit-taking event took place in late August, following which the sharks and whales quickly corrected course and resumed accumulation. This buying then supported BTC’s bullish push. Wallet balance is just one way to classify holders. Another popular methodology in on-chain analysis is using holding time to separate investors between short-term holders (STHs) and long-term holders (LTHs). The cutoff between the two cohorts is 155 days.

The STHs may be considered to represent the fickle-minded side of the market, while the LTHs are resolute diamond hands. These HODLers have been selling recently, however, as CryptoQuant community analyst Maartunn has shared in an X ポスト.

A net 265,715 BTC has exited the wallets of the Bitcoin LTHs over the past 30 days, which is the largest monthly outflow since early January.

BTC価格

Bitcoin has been unable to keep any recovery run going as its price is still trading around $111,000.

コメントを残す