Ethereum’s (ETH) latest price rally has sparked renewed debate over whether the market is nearing a critical turning point. Analysts are looking closely at past cycles for insight, with some suggesting that history may be repeating itself. If the patterns hold true, ETH could be only weeks away from a cycle peak, making this a decisive moment for investors to consider when it might be time to sell everything.

Ethereum’s Cycle Top Signals When To Exit

Crypto analyst Jackis has shared insights into Ethereum’s recent price movements, indicating when investors should exit the market entirely. In a recent X social media post, the analyst noted that the ETH price action is closely mirroring its behavior from previous market cycles.

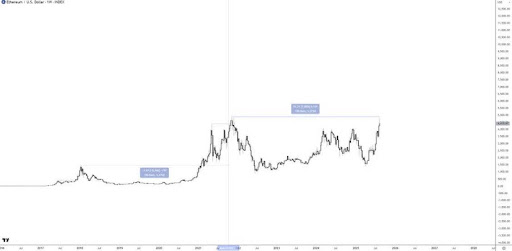

Looking at the chart, Ethereum had hit one of its major cycle tops in January 2018, followed by another peak in November 2021. Moreover, both instances were preceded by a sharp upward trajectory that culminated in heavy corrections. Jackis also points out that in those earlier cycles, ETH was trading significantly above prior highs before topping out. This time, however, the altcoin has not even broken into a new all-time high yet, although it is currently approaching that critical resistance.

Notably, the timing of ETH’s current setup is significant, as the four-year cycle theory suggests that the cryptocurrency could be just four weeks away from a major top. Jackis noted that this window aligns with September, which could serve as a critical moment for investors to reassess risks and consider whether “selling everything” is warranted.

The analyst further highlighted that while Ethereum’s structure shows strength, most altcoins are lagging far behind. Cryptocurrencies such as Binance Coin (BNB), XRP, and Dogecoin (DOGE) have already established their tops in 2021 and remain far below those levels.

Jackie stated that their price action suggests a market environment more consistent with ETH trading around $2,200, rather than its current level below $4,500. Bitcoin, meanwhile, has continued to march higher since its November 2022 lows, forming higher lows and higher highs in a textbook bull market structure.

ETH Panic Selling Or Pre-Breakout Opportunity?

In other news, crypto market expert Ether Wizz argues that the current panic selling of Ethereum mirrors the same mistake traders made with Bitcoin in past cycles. At the time, early sellers underestimated the strength of institutional demand and long-term buyers, only to watch BTC surge far beyond expectations.

The analyst highlighted a recent rebound in the Ethereum price above the 50-week Simple Moving Average (SMA), which historically has signaled the beginning of explosive rallies. The comparison between Ethereum’s 2025 chart and its 2017 breakout also highlights a similarity. In both cases, the cryptocurrency consolidated, reclaimed its moving average, and then accelerated higher.

Notably, Ether Wizz points out that Ethereum could still experience a short-term correction of 5% to 10%. However, he argues it is misguided to assume ETH has already peaked, maintaining instead that the cryptocurrency is in the early stages of a move that could eventually drive its price toward a new all-time high of $10,000.

Lascia un commento