Ethereum’s price action has been volatile in recent weeks, but the asset encountered a significant resistance zone.

With strong selling pressure likely at this level, a rejection followed by a short-term decline appears probable.

Technical Analysis

By Shayan

The Daily Chart

ETH recently found support at the critical $2.5K level and has since jumped toward the $3K region, revisiting the previously broken trendline of the descending wedge. However, this upward movement appears to lack momentum, resembling a pullback rather than a sustained recovery.

Notably, the $3K region coincides with the 200-day moving average, reinforcing it as a strong resistance level where significant selling pressure may emerge. Given this confluence, the likelihood of rejection is high, potentially leading to another bearish move. If sellers regain control, Ethereum could decline further, with the $2.5K level remaining the primary downside target in the mid-term.

The 4-Hour Chart

On the 4-hour timeframe, ETH’s recent bullish retracement is evident as the price inches closer to a key resistance zone. This area includes the lower boundary of the previously broken wedge and aligns with the 0.5 ($2.7K) and 0.618 ($2.9K) Fibonacci retracement levels—both of which historically act as strong resistance zones.

With selling pressure likely concentrated within this range and bullish momentum appearing weak, Ethereum may struggle to break higher. If rejection occurs, the price could reverse toward the $2.5K support level, where a critical supply zone awaits.

Onchain Analysis

By Shayan

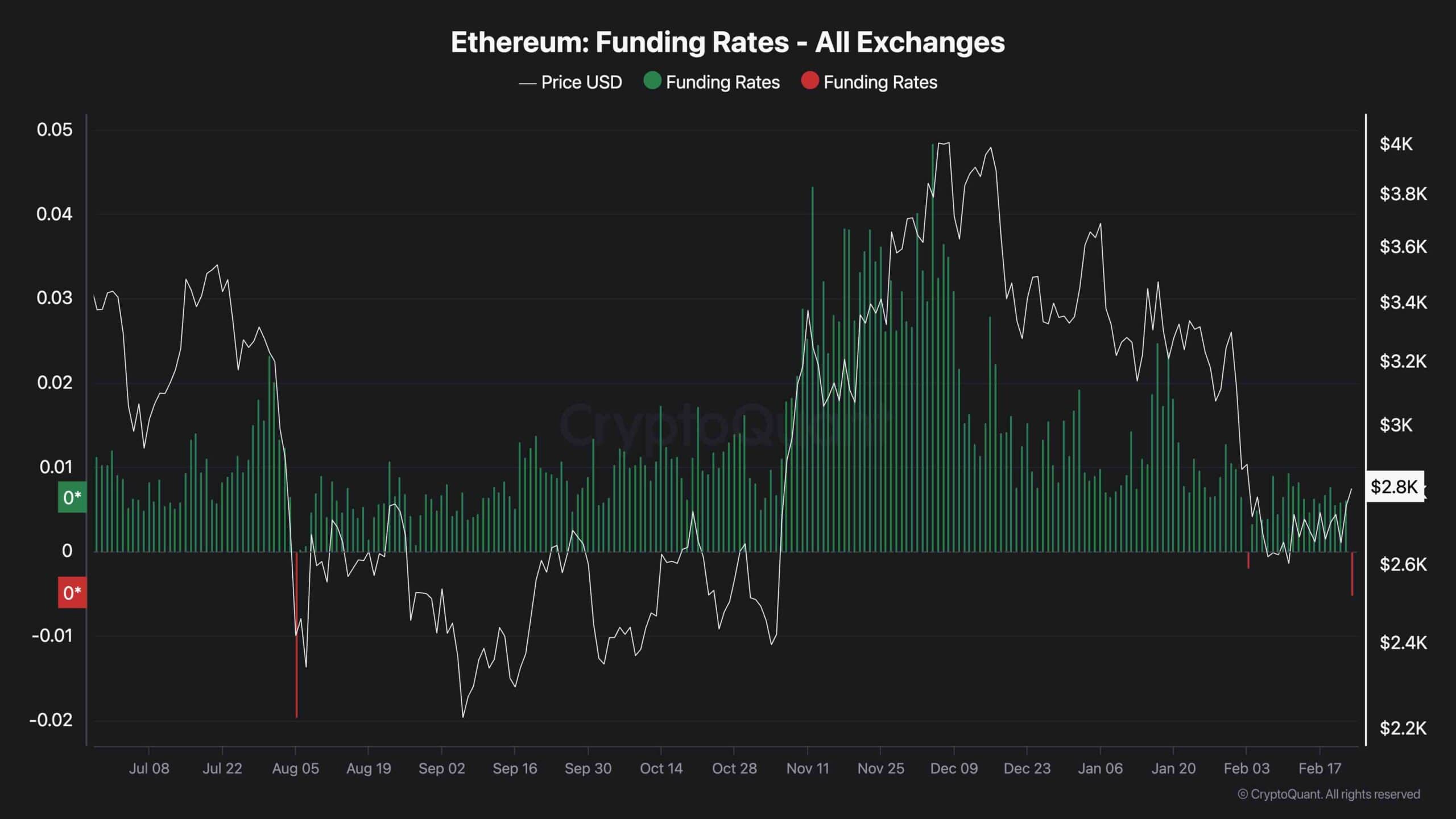

The recent Bybit hack has raised concerns among market participants about its potential impact on price trends. A crucial metric to monitor in this context is the funding rate, which reflects the urgency of buyers and sellers in executing trades.

As illustrated in the chart, funding rates have experienced a sharp decline during the latest market turbulence, even turning negative. This drop suggests heightened selling pressure and fear-driven activity in response to the hack. If this trend persists, particularly with continued resistance at the $3K level, further declines could follow, with sellers eyeing $2.5K as the next major support.

Historically, such steep drops in funding rates often lead to a phase of sideways consolidation with increased volatility. In this case, the $2.5K–$3K range could act as the primary trading zone until market sentiment stabilizes.

Virka Will Weak Momentum Drive ETH to $2.5K? (Ethereum Price Analysis) ilmestyi ensin osoitteessa CryptoPotato.

Vastaa