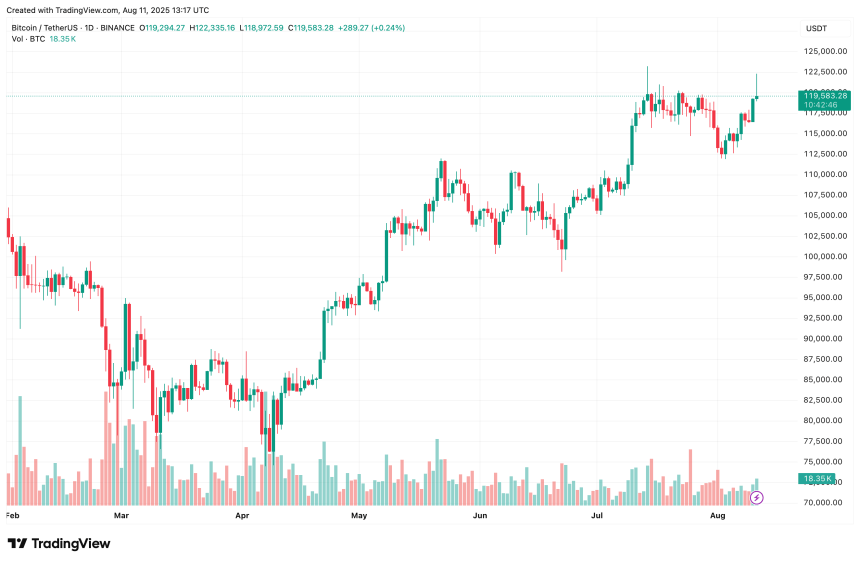

Earlier today, Bitcoin (BTC) surged past $122,000 for the first time since July 13, coming close to a new all-time high (ATH) before paring some gains, trading slightly above $119,500 at the time of writing.

Bitcoin Eyes New ATH With Retail-Driven Rally

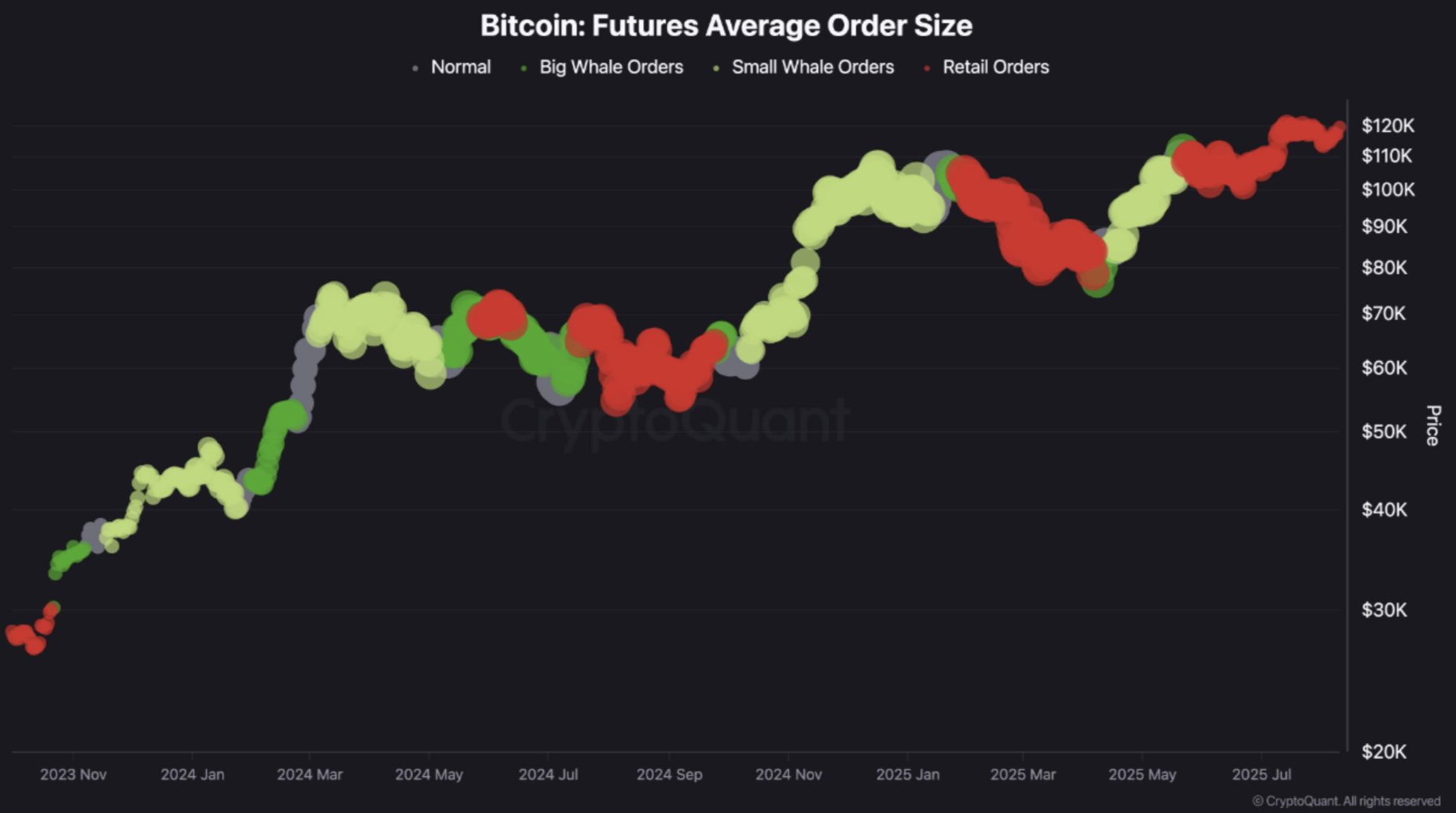

According to a recent CryptoQuant Quicktake post by contributor ShayanMarkets, the average executed order size in the Bitcoin futures market has declined significantly over the past few months. This suggests that the recent price rally is being driven primarily by retail investors rather than institutional players.

For context, the average executed order size is calculated by dividing the total traded volume by the number of executed orders. This metric helps identify whether market activity is dominated by retail participants or large-scale investors.

ShayanMarkets shared the following chart showing large yellow and green clusters in late 2024 and early 2025, which corresponded with substantial whale inflows and fueled strong bullish rallies.

However, recent weeks have seen a noticeable rise in red clusters, indicating that smaller, retail-sized orders are taking a larger share of market activity. The analyst noted that historically, whale dominance near market peaks has often coincided with local tops.

Whale involvement in the BTC futures market has declined since Q2 2025, which could mean that institutional buyers are either holding existing positions from lower levels or waiting for more favorable re-entry points. ShayanMarkets concluded:

This dynamic leaves Bitcoin in a position where a bullish breakout above its prior ATH could materialize in the coming weeks, unless renewed whale activity emerges to offload positions, triggering a distribution phase.

Recent on-chain analysis suggests that BTC may currently be in a distribution phase. In a separate CryptoQuant post, analyst BorisVest noted that investors are employing a strategy called Smart dollar-cost averaging (DCA) to accumulate BTC at current levels ahead of potential price appreciation.

Smart DCA is an upgraded version of the traditional DCA strategy, where investment amounts and timing are adjusted based on market conditions instead of fixed intervals. In crypto, it often uses indicators like moving average or RSI to increase buying during undervaluation phases.

Is BTC At Risk Of A Price Correction?

While rising retail participation in the BTC futures market can signal organic demand for the flagship cryptocurrency, other indicators point to a possible price correction that could disrupt Bitcoin’s bullish momentum.

For example, fresh on-chain data shows an uptick in Binance whale-to-exchange flows, often a precursor to near-term price pullbacks. In addition, recent changes in Bitcoin whales’ realized cap suggest a degree of fragility in the market.

That said, not all signals are bearish. Some analysts believe BTC could be gearing up for another rally in the second half of the year, with targets as high as $150,000. At press time, BTC trades at $119,583, up 0.8% over the past 24 hours.

Napsat komentář