Popular market analyst and key opinion leader (KOL), Ted Pillows, shares an insight into the Solana (SOL) market, stating the altcoin is likely to experience further price corrections in the short term. This price forecast comes amid a general crypto meltdown during which Solana prices have crashed by over 15% in a week.

SOL Charts Hint At Retrace To $140 As Bullish Pattern Forms

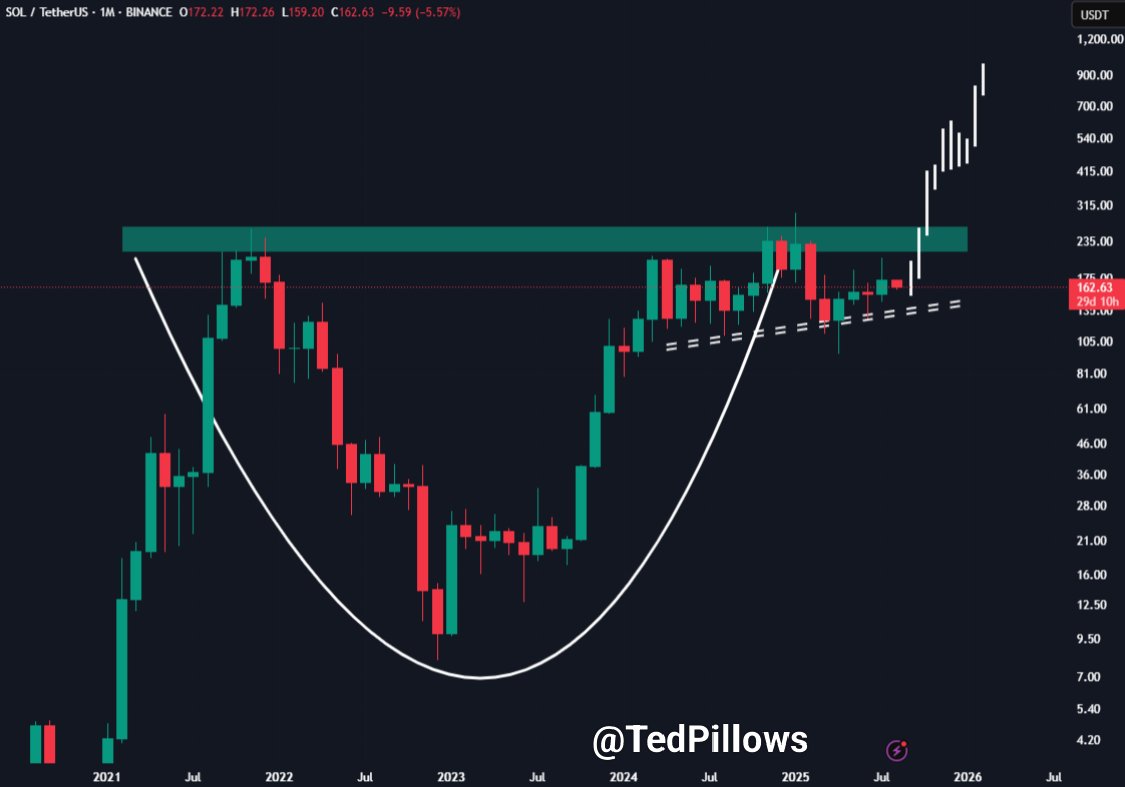

In an X post on August 1, Pillows outlines a Solana price prediction based on a forming cup-and-handle pattern on the monthly chart. In general trading, the cup-and-handle represents a classic bullish continuation pattern. As observed in the chart below, it begins with a tea cup formation where price first declines and then gradually recovers, forming a “U” or bowl-shaped curve.

After the cup, the price pulls back slightly, creating the “handle.” Pillows’ analysis indicates that Solana is currently at this stage of the bullish pattern following a previous price rally to $235 earlier in January 2025. Solana is now undergoing a long-term descending consolidation movement, which Pillows project will lead the altcoin to trade as low as $140-$150.

Presently, SOL trades around $159, indicating the altcoin may still undergo an additional estimated 11% price loss despite the registered heavy corrections in the past week. However, being a bullish continuation pattern, Solana’s successful return to $140-150 price range would also signal a potential price rally.

However, Pillows’ analysis also indicates that the altcoin must first break past the neckline price at $235 to validate such bullish intent. If this scenario plays out positively, the top market analyst predicts Solana to trade as high as $1,000, suggesting a potential 532.91% gain on present spot prices.

Despite recent price corrections, Ted Pillows strongly supports Solana’s bullish potential, noting the altcoin continues to record high levels of network activity, signalling a substantial level of market interest.

Solana Market Overview

At the time of writing, Solana trades at $159.34 after a 3.84% decline in the past day. Meanwhile, the asset’s daily trading volume is also down by 37.85% and valued at $4.98 billion. However, in line with Pillows’ prediction, Solana holds immense potential for future price appreciation, especially as a potential altseason approaches.

The bullish sentiment among SOL investors is also driven by substantial institutional interest in the altcoin among many others. NewsBTC has earlier съобщава that several asset managers, including Grayscale, VanEck, and Fidelity, have also revised their Solana Spot ETF applications with the SEC, indicating ongoing dialogue between both parties in view of a potential approval.

Вашият коментар